GLOBAL ECONOMY

GLOBAL ECONOMIES IN FY 2015-16, CONTINUED TO OPERATE IN A COMPLEX AND DYNAMIC MACROECONOMIC ENVIRONMENT. ALTHOUGH ECONOMIES ACROSS THE WORLD WERE VOLATILE AND LARGELY SAW UNEVEN GROWTH IN 2015, ONE REDEEMING FEATURE WAS THAT RECOVERY CONTINUED.

3.2%

GLOBAL GROWTH IS

PROJECTED TO REMAIN

MODEST AT A 3.2% IN 2016.

China continued to unwind its prior excesses; and ended up going through a phase to rebalance for sustainable growth. However, emerging and export economies were negatively impacted by China's action, as it resulted in a broad-based slowdown in global trade, and turbulence in commodity and other markets.

Oil prices responded to the weak market sentiments and excess supply and fell sharply in early 2016. However, stock market sentiments began to stabilise by mid-February 2016; and by the end of March 2016, they had recovered most or all of the lost ground.

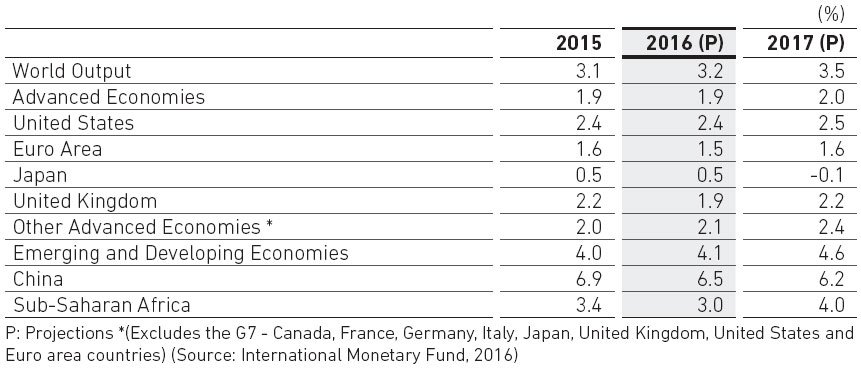

According to the International Monetary Fund (IMF), global growth is projected to remain modest at a 3.2% in 2016, and touch 3.5% in 2017. Emerging markets and developing economies are expected to account for a significant share of global growth in 2016. However, the growth rate is likely to rise marginally compared to last year. The estimated outcome is based on a few assumptions:

- Gradual normalisation of conditions in several economies currently under stress

- Successful rebalancing of China's economy, with trend growth rates that - while lower than those of the past two decades - remain high, visà- vis worldwide growth

- Pick-up in activity in commodity exporters, albeit with relatively modest growth when compared to the past

- Resilient growth in other emerging markets and developing economies, especially India and other South Asian countries

Global growth trend

Latin America

Despite challenges, economic activity across most countries in the continent is expected to pick up in 2017, by 1.5%. Brazil output is expected to contract further on account of recession taking its effect on employment, along with real income and domestic uncertainties continuing to restrain the government's ability to formulate and execute policies.

Among South America's oil exporting countries, Colombia's projected deceleration, with growth easing to 2.5% in 2016 from 3.1% in 2015 is a reflection of low oil prices, along with tightening macroeconomic policies. Elsewhere in South America, the ongoing push to correct macroeconomic imbalances and microeconomic distortions can improve prospects for growth.

Sub-Saharan Africa

The region's significant youth demographic dividend, relative stability and focus of governments to implement reforms for infrastructure creation and employment generation are definite positives.

The growth performance in the region differs across countries, with most oil importers performing reasonably well. According to the IMF, the region's medium term prospects remain favourable, but many countries urgently need to reorient their policies to reinvigorate growth and realise their potential. Towards this end, countries may have to adjust fiscal policies; and for those outside monetary unions, exchange rate flexibility, as part of a wider policy package, should also generally be part of the first line of defence. In the medium term, policies targeted at diversification and financial sector development may also strengthen economic resilience and bolster growth.

INDIAN ECONOMY

INDIA'S STELLAR ECONOMIC PERFORMANCE OF 7.6% GDP GROWTH STANDS OUT AGAINST THE BACKDROP OF A SLOW-GROWTH WORLD. THE COUNTRY CONTINUES TO CONSOLIDATE THE GAINS ACHIEVED IN RESTORING MACROECONOMIC STABILITY.

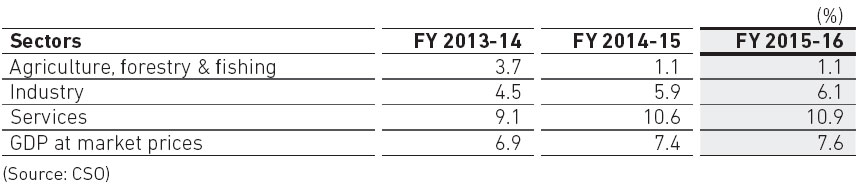

In India, economic activity during the first nine months of fiscal 2016 improved gradually. Gross domestic product (GDP) grew by 7.5% during the first nine months of fiscal 2016, compared to a growth of 7.4% during the first nine months of fiscal 2015. As per industry-wise growth estimates (gross value added), the agriculture sector grew by 0.6%, the industrial sector by 7.4% and the services sector by 9.2% during the first nine months of fiscal 2016 compared to 0.3%, 5.9% and 10.7%, respectively, during the corresponding period of fiscal 2015.

Inflation remained moderate during fiscal 2016. Retail inflation, as measured by the Consumer Price Index (CPI), eased from 5.3% in March 2015 to a low of 3.7% in July-August 2015, and increased subsequently to 4.8% by March 2016. Core CPI inflation, excluding food and fuel products, increased from 4.2% in March 2015 to 4.7% in March 2016. Inflation, as measured by the Wholesale Price Index (WPI), remained negative throughout fiscal 2016; and was -0.9% in March 2016, primarily aided by low commodity prices.

In addition, the current account deficit has declined and is at a relatively lower level, because of the government's continued focus on fiscal consolidation and commodity. The country's foreign exchange reserves rose to US$ 352 billion in early February 2016 and net FDI inflows increased from US$ 22 billion in April-December 2014-15 to US$ 28 billion in the same period of 2015-16. The improvement may be attributed to the government's proactive initiatives to simplify norms and enhance the ease of doing business in India.

The growth in the industrial sector showed some acceleration in the second half of FY 2015-16, primarily on account of growth in the manufacturing sector. By contrast, industrial output measured by the Index of Industrial Production (IIP) could not sustain the base-eff ect surge in October 2015 as it contracted in January 2016. Soft commodity prices brought down input costs sharply. In terms of use-based activity, all segments suff ered output losses, except festival-related demand for consumer durables and intermediate goods in the second half.

The government's 'Make in India' campaign is poised to help India emerge as a hub for global manufacturing giants. The 'Make in India' week held in Mumbai from 13th to 18th February, received an overwhelming response from investors with ` 15.2 trillion (US$ 222 billion) in investment commitments. Moreover, during April-February FY 2015-16, India received US$ 51 billion in foreign direct investment (FDI), the highest-ever FDI inflow in a fiscal.

Indian GDP growth

Outlook

Despite weak monsoons, a challenging export scenario owing to weak global demand and low private investment, India's economy has performed admirably. According to the Reserve Bank of India (RBI), multiple factors could impinge upon the growth outlook for FY 2016-17. First, slow investment recovery amid balance sheet adjustments of corporates is likely to hinder investment demand. Second, with capacity utilisation in the organised industrial sector

estimated at 72.5%, revival of private investment is expected to be tentative. Third, global output and trade growth remain tepid, dragging net exports. On the positive side, the government's ambitious initiatives (Make in India, Startup India, Digital India, Skill India), strong commitment to fiscal targets, and the focus on infrastructure creation are expected to brighten the investment horizon. The government has also taken a series of steps to enhance the ease of doing business which have also helped the FDI inflow into the country improve significantly.

On the other hand, household consumption demand is expected to benefit from a combination of factors: the implementation of the 7th Pay Commission recommendations, continued low commodity prices, past interest rate cuts and measures announced in the Union Budget FY 2016-17 to strengthen rural income. Consumer confidence remains upbeat according to a survey conducted in March 2016 by the RBI with optimism on prospects for income and economic conditions. For FY 2017-18, real growth in GDP is projected at 7.9%, assuming a normal monsoon.

The macro scenario paints a picture of optimism for us at Hero; and we will continue to make the most of that optimism through human ingenuity, progressive technology and consistent value creation for our stakeholders.

ECONOMIC VOLATILITY AND INDUSTRY CYCLES NOTWITHSTANDING, INDIA'S TWO-WHEELER INDUSTRY IS POISED FOR SIGNIFICANT GROWTH, OWING TO THE COUNTRY'S STRONG ECONOMIC PERFORMANCE, RISE IN DISPOSABLE INCOME, GROWING URBANISATION, EMPOWERMENT AND PARTICIPATION OF WOMEN IN WORKPLACES, ACCELERATED CONSTRUCTION OF ROADS AND HIGHWAYS ACROSS THE COUNTRY AND THE POSSIBILITY OF A RURAL RECOVERY. INDIA'S LARGE YOUTH BULGE (OVER 65% OF THE POPULATION IS 35 OR UNDER, AND HALF THE COUNTRY'S POPULATION IS UNDER 25 YEARS OF AGE) IS ALSO A CATALYST FOR INDUSTRY GROWTH.

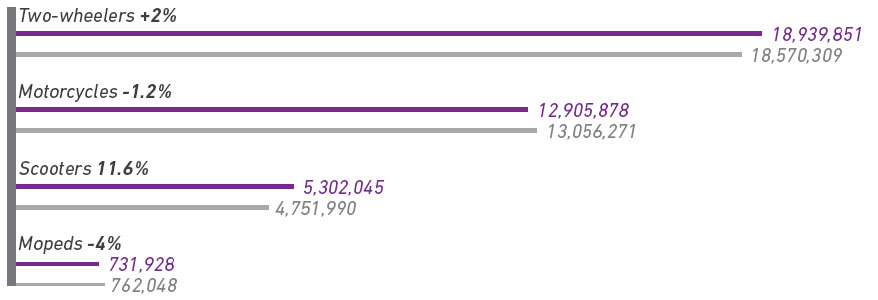

India's two-wheeler industry saw a mixed FY 2015-16 with the first half remaining dull and sales picking up in the second half of the year. Overall, the two-wheeler industry witnessed a marginal 2% growth in FY 2015-16, compared to the previous year. The overall industry (domestic and export) increased from 18.57 million units in FY 2014-15 to 18.89 million units in FY 2015-16. Following are the reasons for tepid growth in the industry:

- Consecutive subnormal monsoons and unseasonal rain, led to poor crop realisation; moderating wages in rural markets; insufficient government support on crop pricing (read MSP) and lower spend on rural infrastructure spend impacted the rural economy as a whole

- Although India has become one of the fastest growing economies in the world, driven by robust policy initiatives, growth uptick picked up primarily in the second half of FY 2015-16

- Global headwinds, coupled with adverse currency movement in some of the key emerging markets impacted exports growth

Motorcycle sales, which account for nearly 70% of the overall (domestic and exports) industry pie, declined marginally by 1.2%, from 13.06 million units in FY 2014-15 to 12.90 million units in FY 2015-16.

Scooter sales grew at a substantial 11.6%, from 4.75 million units in FY 2014-15 to 5.30 million units in FY 2015-16. Manufacturing players have also aggressively expanded their distribution network to reach out to customers. Positioning of scooters as a gender-neutral 'family' vehicle is seen as a key reason for its widespread preference.

Owing to low sub-urban and rural demand, moped sales also dipped by 4%, from 0.76 million units in FY 2014-15 to 0.73 million units in FY 2015-16.

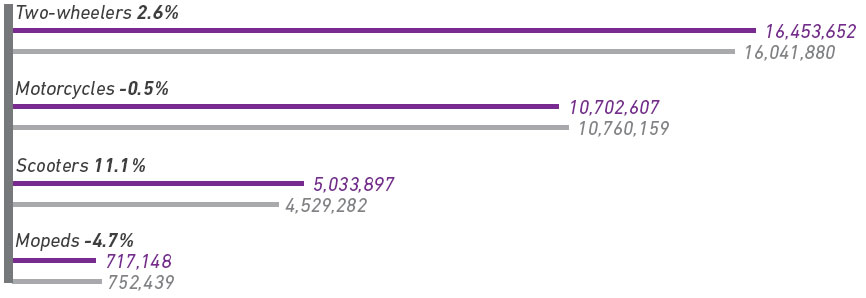

The domestic two-wheeler industry volumes grew by 2.6% from 16.04 million units in FY 2014-15 to 16.45 million units in FY 2015-16.

Motorcycle sales declined marginally by 0.5%, from 10.76 million units in FY 2014-15 to 10.70 million units in FY 2015-16. The scooter category saw an 11.1% sales growth, from 4.52 million units in FY 2014-15 to 5.03 million units in FY 2015-16. Moped sales declined by 4.7% from 0.75 million units in FY 2014-15 to 0.71 million units in FY 2015-16.

The growth is primarily driven by continued urbanisation and introduction of new models.

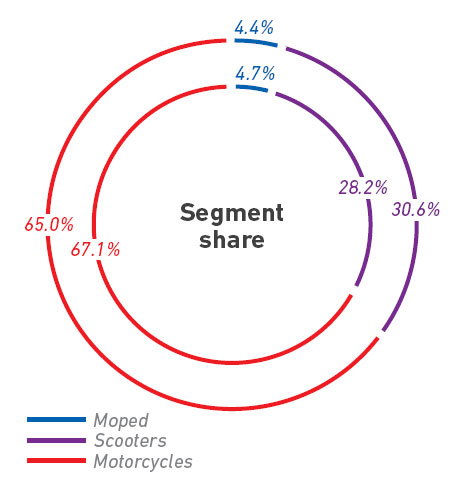

Two-wheeler Industry - Segmental break-up

Motorcycles continue to dominate India's two-wheeler industry with a lion's share of 65.0%.

Scooter's share in the overall industry grew from 28.2% in FY 2014-15 to 30.6% in FY 2015-16. Mopeds share fell by 0.3% compared to FY 2014-15.

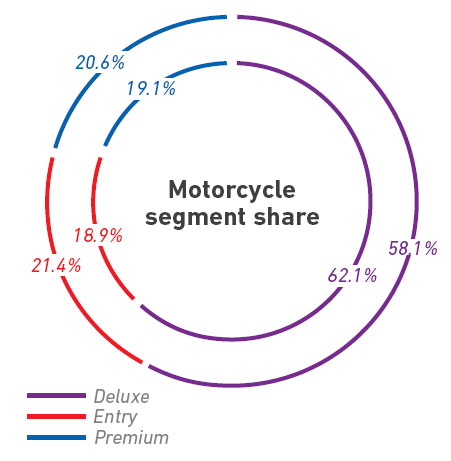

In the motorcycles segment, the share of premium segment has grown (y-o-y) by 1.5% and entry segment by 2.5%, while the share of deluxe segment has reduced by 4.0%. Premium segment crossed the entry segment in percentage proportion in the motorcycle industry during Q4 of FY 2015-16.

Two-wheeler industry (overall)

Two-wheeler industry (domestic)

Segment-wise break-up (domestic)

Two-wheeler industry (exports)

The exports of two-wheelers declined by 1.7% to 2.48 million units in FY 2015-16 from 2.52 million in FY 2014-15. This happened on account of global economic slowdown and adverse currency movements in some of the emerging markets. The total share of exports from India has declined by 50 bps from a high of 13.6% in FY 2014-15 to 13.1% in FY 2015-16.

The motorcycle segment witnessed a decline (y-o-y) of 1.7%. On the other hand, scooter segment grew (y-o-y) by 20.4%, owing to the introduction of new models. Moped exports on a low base grew by 53.6% in FY 2015-16, compared to the previous financial year.

65.0%

MOTORCYCLES CONTINUE

TO DOMINATE INDIA'S TWO-WHEELER

INDUSTRY WITH A

LION'S SHARE OF 65.0%.

INDUSTRY OUTLOOK

Short-term

In the short-term, domestic consumption of two-wheelers is expected to be primarily driven by two factors: a) recovery in rural demand led by anticipated good monsoon in the year; and b) implementation of 7th Pay Commission recommendations; and One Rank One Pension (OROP), enhancing spending of government employees.

Moreover, changeover to BS IV from April, 2016 in the new models and April, 2017 in the existing models may lead to a short-term impact on the volume of sales.

Long-term growth drivers

India's two-wheeler industry is poised to grow sustainably for the long-term, owing to the following growth drivers:

- Burgeoning middle-class population with increasing disposable income

- Higher trend of urbanisation

- India is home to a huge proportion of young people; and will enjoy demographic advantage in the near future

- India's rural income is projected to improve led by farm and non-farm demand recovery

- Rapidly populating urban areas will continue to increase urban congestion requiring commuters to look for alternate quicker and more economical mode of transport

- Accelerated construction of roads and highways in India will encourage personal mobility

- Penetration of two-wheelers has significant opportunity to improve from current levels

Evolving trends

- Large proportion of sales is expected to emerge from rural India, based on increasing rural market penetration; new households will enter the addressable income segment. Rural sales will continue to drive the growth of entry and deluxe segment two-wheelers

- Customer preferences are rapidly changing from basic commuting in the past to present day's multiple ownership, powered by 'commuting with leisure' and increased usage by family and specially by women

- Consumption driven by 'Choice' instead of 'Need' is expected to increase in urban areas. This, coupled with favourable lower base, is expected to push the rapid growth of premium segment of twowheelers; and elevate the design, styling and technology to the next level in line with global standards

- Utility and ease of use expected to drive growth of scooters segment

- Design evolution, new technology and product specification upgrades are likely to encourage the adoption of higher segments

- Upcoming emission regulations (in line with global standards) are expected to further upgrade the technology prowess of manufacturers; and position India as the global hub for two-wheelers

AT HERO, WE ARE CONSTANTLY FOCUSED ON DEVELOPING NEW TECHNOLOGIES, INNOVATION AND EXECUTION EXCELLENCE TO DESIGN AND DEVELOP PRODUCTS THAT DELIVER A DELIGHTFUL CUSTOMER EXPERIENCE TO MILLIONS OF PEOPLE WORLDWIDE.

OPERATIONAL CANVAS

Hero MotoCorp Ltd (HMCL) continues to sustain its leadership at the pinnacle in an intensely competitive industry landscape. For 15 consecutive years, it has remained the world's largest two-wheeler manufacturer in terms of annual sales by a single company in a calendar year.

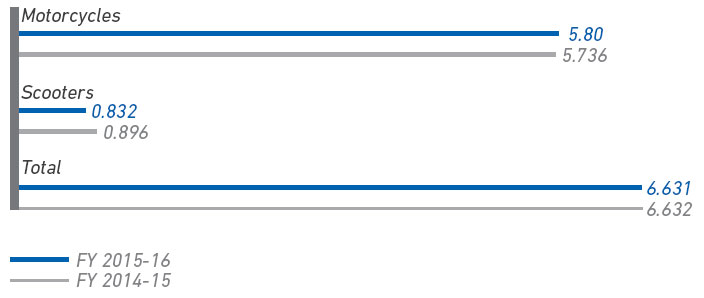

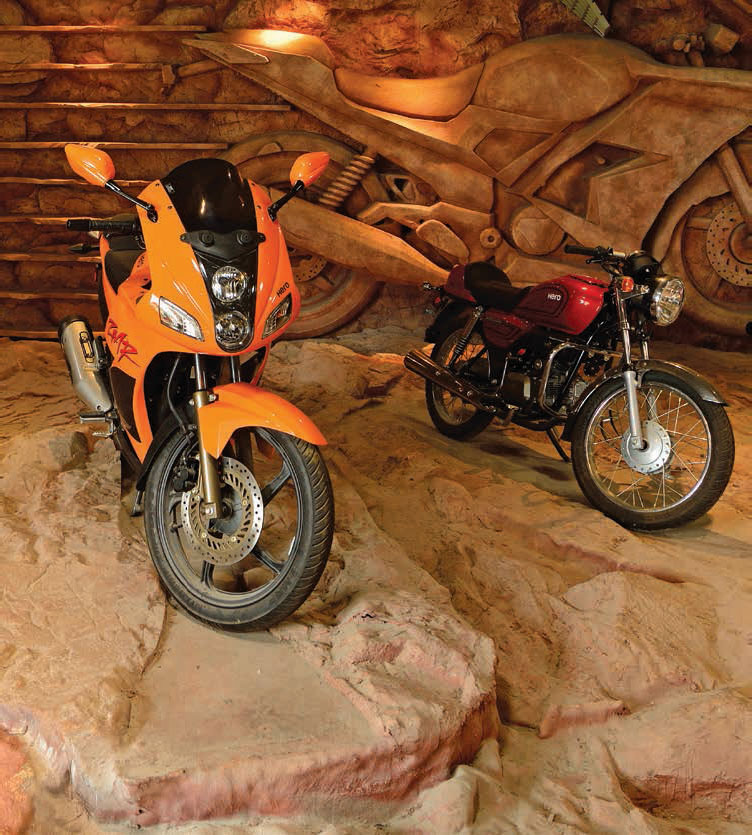

In FY 2015-16, the Company sold 6.63 million units, achieving the distinction of clocking more than 600,000 unit sales for three months during the year. Hero MotoCorp remains the only Indian two-wheeler company to achieve 6 lakh-plus sales in one month; and that too on multiple occasions. In the motorcycle segment (domestic and export), sales remained flat at 5.74 million units in FY 2015-16. The Company maintains its formidable leadership in domestic motorcycles market with 52.4% share, selling 5.60 million units in FY 2015-16.

In the scooter segment (domestic and exports), the Company's sales grew by 7.9% from 0.83 million units in FY 2014-15 to 0.90 million units in FY 2015-16. The Company registered strong growth in the scooter segment, backed by the launch of two new scooters: Maestro Edge and Duet – the first of the products to have been completely designed and developed by the in-house R&D team of Hero MotoCorp.

CENTRE OF INNOVATION AND TECHNOLOGY (CIT)

During FY 2015-16, the Company inaugurated the state-of-the-art 'Centre of Innovation and Technology' at Jaipur in Rajasthan, built with an investment of ` 850 crores to design and develop world-class products for India and global markets. Home to a talent pool of around 500 automotive experts with global and local expertise, the Centre has best-in-class laboratories, design studios and 16-km-long advanced test tracks with 45 different surfaces to simulate Indian and international road conditions. This facility indeed is a giant stride in HMCL's endeavour towards strengthening its in-house technology capabilities.

With the CIT now operational, your Company has the ideal combination of world-class infrastructure and talent pool to 'Innovate in India', for the world. It is now for your Company to capitalise on the opportunity of best-in-class soft and hard infrastructure to lead Hero's next level of growth.

ALL FOUR HERO SCOOTER

BRANDS FEATURE IN THE TOP

10 IN FY 2015-16 DOMESTIC

SCOOTERS MARKET. MAESTRO

EDGE AND DUET HAVE DONE

WELL, AND HAVE BEEN

CONSISTENTLY REGISTERING

IMPRESSIVE NUMBERS

MONTH-ON-MONTH SINCE

THEIR LAUNCH IN SEPTEMBER

2015 AND NOVEMBER 2015

RESPECTIVELY.

SEGMENTAL REVIEW

Motorcycles

Sales in the entry segment grew by 5.3% to 1,167,828 million units, resulting in a segment share of 51.1% in FY 2015-16. In the premium segment, the Company registered a 16.2% decline, with sales of 105,296 million units and 4.8% segment share in FY 2015-16. In the deluxe segment, the Company's sales declined by 2.6% to 4,330,012 million units, but with a higher segment share of 69.7% in FY 2015-16 as compared to 66.5% in FY 2014-15.

Importantly, 6 out of top 10 motorcycle models on road in India belonged to the Hero brand in FY 2015-16.

Splendor remains India's highest selling two-wheeler brand with close to 2.5 million unit sales in the domestic market in FY 2015-16. Splendor, HF and Passion brands lead the Indian motorcycle industry at No. 1, 2 and 3 spots with combined sales of close to 4.8 million units.

Hero MotoCorp further strengthened its leadership share in roughly 80% of the total motorcycle market (sub 110cc and 125cc).

Scooters

All four Hero Scooter brands feature in the top 10 in FY 2015-16 domestic scooters market. Maestro Edge and Duet have done well, and have been consistently registering impressive numbers month-on-month since their launch in October 2015 and November 2015 respectively. Both the models jumped to 3rd and 4th position, respectively in the domestic market, since their respective launches.

GLOBAL BUSINESS

At Hero MotoCorp, we continue to work hard towards building a track record across international geographies. We now have presence across 29 countries worldwide up from 22 countries in the previous year. We continue to invest in our global facility and operations.

During FY 2015-16, the Company exported 210,409 units, compared to 200,140 units in FY 2014-15, a 5.1% growth in sales volumes, despite a sluggish global environment and adverse currency movements. In the motorcycle segment (export), the Company's sales grew by 10.4% from 120,184 units in FY 2014-15 to 132,732 units in FY 2015-16. During FY 2015-16, Hero MotoCorp's first overseas manufacturing facility in Villa Rica near Cali in Colombia became operational. This plant will act as a hub for exports to the Andean countries. The plant will have an initial production capacity of 80,000 units per annum, which will be expanded to produce 150,000 units annually, in the next phase.

OUTLOOK

We continue to strive towards our long-term vision of sustainable global leadership. For over three decades, we have built bestin- class mobility solutions spread across multiple segments for a diverse spectrum of customers. Leveraging our rich experience and expertise, we are strengthening our leadership in India while reaching out to customers in markets across Asia, Africa and South and Central America.

The new world-class Hero CIT in Jaipur and our proven manufacturing excellence will enable us to expand our range of offerings, elevate performance standards and create new segments in India and in global markets. We also strive to ring-fence our core of market leadership in the largest selling entry and deluxe segments by introducing truly innovative and youthful range of products.

Simultaneously, we aim to grow our share in the premium segment by expanding the range of our products for domestic and global markets. 'Premiumisation' represents the core of the Company's strategy to fast-track entry into newer segments and global markets.

HERO MOTOCORP HAS BEEN CONSISTENTLY DELIVERING STRONG FINANCIAL PERFORMANCE AND FY 2015-16 WAS NO EXCEPTION.

There was no exceptional expense during the year, the Company's marketing and publicity spend was 0.1% higher than the previous year. Hero MotoCorp is going global on a large-scale, with plans of entering 50 markets by 2020. Manpower expenses increased by 0.4% on a Y-o-Y basis to shore up employee strength at both CIT and Neemrana facility in Rajasthan.

SALES

During FY 2015-16, the Company registered total sales of 66,32,322 units up from 66,31,826 units. In value terms, total sales (net of excise duty) increased by 3% to ` 28,160 crores in FY 2015-16 from ` 27,351 crores recorded in the previous fiscal year.

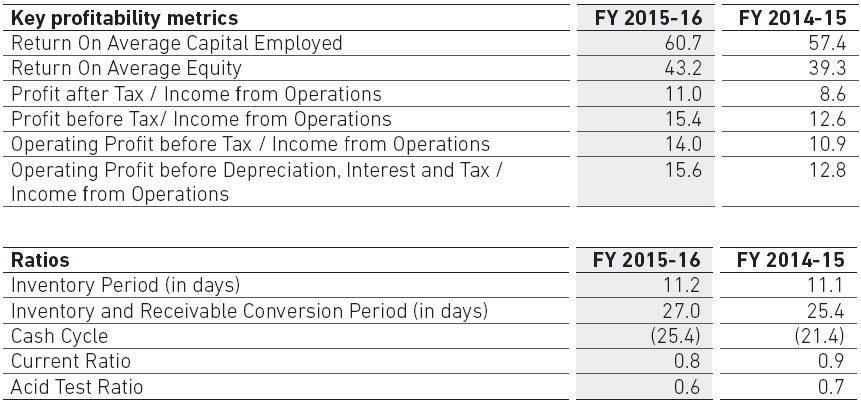

PROFITABILITY

The Company's earnings before interest, depreciation and taxes (EBITDA) margins increased from 12.8% in FY 2014-15 to 15.5% in FY 2015-16. Moreover, the Company's operating margins increased from 10.9% to 14.0% during the same period. The Company's operating profit (PBT before other income) also increased from ` 3,002 crores in FY 2014-15 to ` 4,006 crores in FY 2015-16.

OTHER INCOME (INCLUDING OTHER OPERATING REVENUES)

The Company's other income increased by 14% from ` 727 crores in FY 2014-15 to ` 830 crores in FY 2015-16.

CASH FLOWS

During the year, the free cash flow from operations stood at ` 3,914 crores (previous year ` 2,250 crores). These cash flows were deployed in capital assets including the setting up of our Centre for Innovation & Technology (CIT), investments and also paid out as dividend during the year.

RAW MATERIAL COST

During FY 2015-16, metal prices were volatile, particularly steel, copper, aluminium and nickel. Raw material costs as a proportion of sales declined from 72.2% to 68.6% as a consequence of lower commodity prices and internal cost control measures (LEAP).

CURRENT ASSET TURNOVER

The Company's current asset turnover, indicating sales as a proportion of average current assets (excluding investments) declined from 10.7 times to 10.3 times. This was primarily due to higher average inventory, trade receivables and loans and advances.

DEBT STRUCTURE

The Company has been debt-free for the past 15 years and incur no borrowing costs. Finance cost includes interest on account of advances from dealers and other transactional costs.

DIVIDEND POLICY

Over the years, Hero MotoCorp have consistently followed a policy of paying high dividends, keeping in mind the cash-generating capacities, the expected capital needs of business and strategic considerations. For FY 2015- 16, the Board recommended a dividend of 3,600%, compared to previous year's 3,000%. The Company kept a payout ratio of 55.24% compared to 59.6% in the previous year.

WORKING CAPITAL MANAGEMENT

Hero MotoCorp has always sought to efficiently use the various components of its working capital cycle. It has also effectively controlled the receivables and inventories, enabling us to operate on a negative working capital.

WE CONTINUOUSLY KEEP EVOLVING INNOVATIVE WAYS TO STRENGTHEN OUR CUSTOMER ENGAGEMENT, EDUCATE THEM ABOUT NEW LAUNCHES, ADDRESS THEIR CONCERNS AND STIMULATE CONVERSATIONS ABOUT OUR BRAND. THIS IS BECAUSE WE BELIEVE OUR CUSTOMERS ARE OUR TRUE BRAND ADVOCATES. WE WILL CONTINUE TO WIDEN OUR CUSTOMER TOUCH POINTS ACROSS THE RURAL AND URBAN LANDSCAPE; SO THAT OUR BRAND AND ITS VALUE PROPOSITION REMAINS AS RELEVANT TO FIRST-TIME BUYERS AS ALSO TO LONG-TIME LOYALISTS.

HERO GOODLIFE

Hero MotoCorp's GoodLife Programme (a customer relationship programme) is one of the largest customer loyalty programmes in India's automotive industry, with over 10 million users. The programme is aimed at enhancing customer satisfaction and initiate a higher level of engagement with members by making them brand ambassadors to generate referral sales and bolster service visits. The programme aims to increase revenue opportunities for our dealers and to increase customer volumes as well as overall transactions.

The programme was revamped this year with the addition of more attractive branded gifts for the loyal members. The members have also been provided an option to redeem accumulated points against their service bills.

Hero GoodLife Programme has been adjudged the winner in the Category 'Best Loyalty Programme in Automobile Sector' at the Ninth Loyalty Awards organised and presented by AIMIA.

BHARAT SHRESTH WAVE

The Bharat Shresth Wave is an important step in Hero MotoCorp's rural initiative, as part of the overall 'Har Gaon, Har Angan' (Every Village Every Household) platform. This initiative was undertaken with the following objectives:

- Strengthen our rural market reach with last mile penetration

- Build enduring relationships with opinion leaders, influencers and brand advocates

- Leverage the relationship to help business through improved retail performance

- Engage customers through various marketing initiatives for desired brand visibility in the hinterland

- Provide best-in-class sales and service experience to our customers

- Identify and implement simple, innovative and scalable methods to approach rural markets

10million

CUSTOMER BASE OF HERO

MOTOCORP'S GOODLIFE

PROGRAMME (CUSTOMER

RELATIONSHIP PROGRAMME),

ONE OF THE LARGEST IN INDIA'S

AUTOMOTIVE INDUSTRY

ACHIEVEMENTS OF FY 2015-16

19,655

OPINION LEADERS

ENGAGED

3,500+

LOAN MELA, EXCHANGE MELA

AND HAAT ACTIVATIONS

ORGANISED

700+

RURAL SUPPORT EXECUTIVES

(RSES) GO OUT TO HAATS AND

MANDIS IN RURAL MARKETS

TO GENERATE BUSINESS

LEADS

KHUSHIYAN HAR ANGAN 2015

Through the Khushiyan Har Angan 2015 programme, we intend to build upon 'Enduring Relationship' with opinion leaders and customer focus groups. This platform enables us to showcase our new products and talk about their functional benefits, product warranty and GoodLife programme, among others. In FY 2015-16, Khushiyan Har Angan was conducted at 130 dealerships across India; we engaged with around 13,000 opinion leaders.

LEVERAGING GOVERNMENT INFRASTRUCTURE

We are working on a strategy to reach out to every village by utilising government infrastructure as an alternative business channel. We are the first two-wheeler company to have tied-up with Common Services Centres (CSCs), under the Ministry of Information Technology. We conducted sales and service training through more than two lakh centres spread across India.

'Chalo Sakhee, Pleasure Seekhein' aims to build brand awareness, impart product information and nurture long-term relationship with rural women by utilising Anaganwadi workers to train rural women to learn riding on Pleasure. During FY 2015-16, we trained over 1,500 women and aim to train over 6,000 women in FY 2016-17.

TRUST OF HERO

GENUINE PARTS

AT HERO, OUR OBJECTIVE IS

TO PROVIDE A NEVER ENDING

DELIGHTFUL EXPERIENCE TO OUR

CUSTOMER

SETTING INDUSTRY BENCHMARKS

Hero Genuine Parts are the only certified parts for your Hero two-wheelers. They are engineered with precision as a perfect fit for your bike to provide you with enhanced and unmatched performance. Every part goes through a strenuous test of critical quality check points before becoming a Hero Genuine Part. These parts are also now supplied through Global Parts Centre (GPC) in Neemrana.

Our state-of-the-art GPC manufacturing facility with cutting edge systems that not only facilitates supply chain processes but also provides a pleasant, healthy, and beautiful work environment. Spread over 35 acres, GPC along with the equally imposing Hero Garden Factory are an integral part of Hero Neemrana Complex in the state of Rajasthan, India. Based on lean manufacturing systems, GPC is designed to have minimal manual intervention while significantly enhancing productivity. This technological marvel is a new industrial benchmark in the auto sector. It is equipped with automated storage and retrieval system (ASRS) and automated packaging and sorting system apart from other new age concepts like Uni-Shuttle and Rail Guided Material movement systems controlled by on-line tracking of parts, through a customised and unique Warehouse management system. Following green building concept, Indian Green Building Council (IGBC) has accredited as a platinum class manufacturing facility.

KEY DEVELOPMENTS OF FY 2015-16

Business outreach: We expanded our network through 11 new parts distributors taking the total count to 92. We have expanded our secondary network to over 18,750 retail outlets.

Asli Hero: A drive to connect with the technicians across the country was launched in December 2015 enabling higher visibility and awareness of our genuine parts.

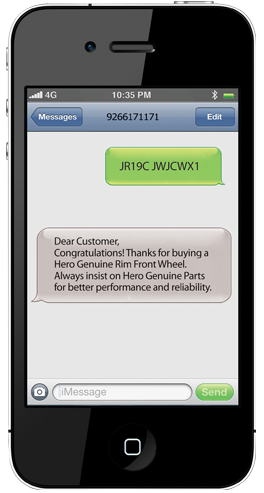

Anti-counterfeit initiatives: Our original Hero Genuine Parts bear the Unique Parts Identification (UPI) code. Customers can confirm the genuineness of the part by sending UPI code through SMS on 9266171171. The MRP sticker also contains many salient features such as 'Colour shift Ink', HGP logo visibility under UV light, etc. The MRP sticker contains Hero Logo in Guilloche Text Pattern.

As part of its ongoing initiative to curb the menace of spurious parts, Hero MotoCorp launched stringent action against the manufacturers and traders of spurious parts and counterfeit products under the initiative 'Fight Fake, Stay Safe'.

Brand building: We did an extensive brand building activity to enhance awareness about using genuine parts. This was instrumental in ensuring widespread distribution of Hero Genuine Parts resulting in the robust growth achieved in parts business.

GIVEN THE PACE AND SCALE OF DISRUPTION IN BUSINESSES AND THE TECHNOLOGY LANDSCAPE, A FLEXIBLE BUT ROBUST SUPPLY CHAIN NETWORK IS CRITICAL FOR SUCCESS. WE ARE WORKING TOWARDS UPGRADING OUR NETWORK IN COLLABORATION WITH OUR SUPPLY CHAIN PARTNERS CONTINUOUSLY. WE SHARE OUR INSIGHTS WITH PARTNERS TO HELP THEM ENHANCE OPERATIONAL EFFICIENCIES AND BUILD A PRUDENT COST STRUCTURE. THE RESULT IS AN ECOSYSTEM THAT IS FAST, RELIABLE AND SEAMLESS.

EFFICIENT INVENTORY MANAGEMENT

Our inventory management performance continues to improve over the years, with our inventory turnover, improving by 11% in FY 2015-16.

ENHANCE EFFICIENCIES AND ROBUSTNESS OF SUPPLY CHAIN

We outsourced logistics services to professionally managed resources. This has enabled us to optimise the load per transporting unit, visibility and control of logistics cost, reliability of transportation and truck traffic decongestion.

We have undertaken major initiatives to reduce carbon footprint in inbound vehicles and utilise trucks in a better manner.

STRENGTHENING SUPPLY CHAIN

We entered into strategic partnerships with key suppliers for critical engine and emission controls part with local and global suppliers. We are gearing up for upcoming emission (BSIV / BSVI) and safety (ABS/ CBS) regulations through capability creation and in-house by aligning with best-in-class global suppliers.

STRATEGIC PARTNERSHIP

We entered into a joint venture (JV) with Magneti Marelli (MM) for Fuel Injection (FI) System parts. The JV will build advanced solutions for engine control and raise the level of solutions to fulfil future technology and regulatory requirements.

LEAP (A COST OPTIMISATION INITIATIVE)

Our LEAP initiative completed three years of journey. During FY 2015-16, LEAP enabled enhancing:

- Design optimisation

- Cost optimisation across operations and logistics

- Product variant and supplier operation excellence

The programme has helped your Company improve its gross margin levels ahead of a similar improvement by other manufacturers.

A new Six Sigma programme has been launched, which encompasses our supply chain partners. We have more than 350 members who have been imparted awareness about the training modules.

OTHER ACHIEVEMENTS

We obtained compliance for the 'Conformity of Production (COP)' from safety critical component suppliers; and implemented practices to get COP tested periodically.

During FY 2014-15, we successfully implemented e-material flow in two of our manufacturing locations; and will implement that in other manufacturing locations in FY 2016-17.

ROAD AHEAD

- Exploring new transportation design and logistics methods to achieve best-in-class logistics efficiency

- Implementing vertical and horizontal reciprocating conveyor concepts in material management to support DOL concept; and achieve the least industry turnaround time

- Conducting layout and material routing validation by 3D simulation in a digital manufacturing environment

- Providing services, which are aligned with the organisation's vision and mission

INFORMATION TECHNOLOGY AT HERO IS NOT JUST A SUPPORT FUNCTION FOR BUSINESS, IT IS A CRITICAL ENABLER OF VALUE CREATION. STARTING FROM OPERATIONS TO BUSINESS STRATEGIES TO THE WAY WE COMMUNICATE WITH OUR STAKEHOLDERS, INFORMATION TECHNOLOGY STREAMLINES THE ENTIRE ECOSYSTEM AND MAKES IT MORE COHERENT.

To further strengthen our connect with digitally savvy customers, some of the initiatives undertaken during the year were:

Mobile app for customers: An interactive mobile app to enhance the customer interaction with the organisation. Customers can use the app at the time of service of their product and also get useful product related information.

Online booking of two-wheelers: With an aim to provide digital flexibility to our prospective customers, we tied up with a third-party portal for online selling of our two-wheelers. Customers can now choose and book their two-wheelers through our website. We have sold over 300,000 two-wheelers through this channel.

Social engagement: During FY 2015-16, we conducted multiple social campaigns to engage with customers and used the social media to respond to customer queries/concerns and to extend the reach of our brand across the globe.

Some of the noteworthy initiatives carried out by other stakeholders and ably supported by the IT include the following:

Digital manufacturing: We implemented the digital manufacturing solution at the Gurgaon facility. This solution is being implemented at our upcoming facilities in Gujarat and Bangladesh which will improve production efficiency and reduce cost.

Power of IT for social causes: Our Hamari Pari campaign (for girl child empowerment) on social media received nearly 2 million views and the Ride Safe India Campaign (on road safety) received over 24 million views. We also participated in a twitter chat on road safety and our hashtag #ridesafeindia received wide acclaim.

SUPPLY CHAIN DIGITISATION

ACHIEVEMENT

AT HERO, WE HAVE

SUCCESSFULLY REDUCED

85% OF MANUAL

INTERVENTION, WITH 95%

SCHEDULE ADHERENCE. THE

INVENTORY CARRYING COST

REDUCED TO 40% VIS-À-VIS

PREVIOUS YEAR.

THE FOCUS AT HERO IS TO BUILD A BEST-IN-CLASS ORGANISATIONAL CULTURE TO ATTRACT, BUILD AND RETAIN TALENT ACROSS LEVELS, GLOBALLY. WE ARE COMMITTED TO PARTNER WITH EMPLOYEES AND STRENGTHEN OUR TALENT POOL BY PROVIDING THEM GROWTH AND CAREER ENHANCEMENT OPPORTUNITIES.

TALENT ACQUISITION

During FY 2015-16, over 630 professionals were recruited to join Hero MotoCorp. Coming from reputed organisations with relevant experience including 100+ graduates from reputed engineering and management campuses. We also brought on board several new leaders through lateral placements across functions to drive business growth globally.

Launch of the Hero Challenge: During the year, we launched our first Business school competition, based on scenario planning exercise. The competition attracted participation from India's premier management institutions.

JOB ANALYSIS AND EVALUATION

We partnered with a reputed HR Consulting firm to work on Job Analysis Evaluation project across the organisation. This project will help streamline career planning and competency development for our managers. The outcome of this exercise will facilitate in the creation of strengthening high-performance culture in the organisation.

LEADERSHIP DEVELOPMENT

In order to develop a robust succession pipeline for our leadership and critical positions, a regular talent review exercise is conducted. This is further being supplemented by providing multi-domain exposure by means of job rotation and expanded leadership responsibilities. Young talent is also being groomed by providing exposure to world-class programmes in management at reputed B-schools. In addition hi-potential talent is provided focused leadership and functional development programs in collaboration with reputed management schools in India and abroad.

We also upgraded our Leadership Competency Framework, shifting the focus from grade-based competencies to role-based competencies. This will help employees develop competencies as per their role requirements as well as help define their way forward.

DIVERSITY & INCLUSION

We encourage 'Diversity & Inclusion' in our team through a series of interventions:

Women in Leadership (WIL) Programme: Hero MotoCorp launched Women in Leadership (WIL) programme for female employees in collaboration with BML Munjal University and Imperial College of London. This programme will provide critical inputs on leadership development that empowers women employees to take leadership roles in future.

EMPLOYEE ENGAGEMENT

Chairman, CMD & CEO Town Hall: Town Hall meetings were organised where Mr. Pawan Munjal addressed all employees of Hero and shared his vision for the Company. He took questions from the audience in order to get the pulse of our people.

Hero Achiever's Award: Recognising exemplary performance at work, team and individual awards were conferred under five categories - Operational Excellence, Customer Delight, Innovation at Work, Sustainable Cost Reduction Initiative (LEAP), and Living Hero's Core Values to deserving candidates during the year.

MotoPassion: MotoPassion at Hero enhances curiosity about our products among employees through knowledge-sharing and interactions. This is a highly and engaging intervention has been launched to cover all employees in offices and plants.

INDUSTRIAL RELATIONS

We practice a highly evolved and positive employee relations framework. In all our factories, our employees get ample opportunities to develop, suggest improvements and resolve issue through proactive dialogue, suggestion programmes and TPM initiative. Throughout the year, the plant operations ran smoothly without any disturbances or work stoppages largely because of proactive engagement and development of all our associates.

RISK MANAGEMENT AT HERO IS A CONTINUOUS ENTERPRISE-WIDE FUNCTION, WHICH ENSURES THAT RISKS ACROSS THE ORGANISATION ARE IDENTIFIED, REVIEWED REGULARLY AND COUNTER MEASURES REMAIN FIT FOR PURPOSE.

OUR RISK MANAGEMENT OBJECTIVES

- Mandated and integrated with all business processes and linked to the achievement of our strategic objectives

- Standardised and structured through a continuous process of identification, analysis, mitigation, monitoring and reporting

- Open and transparent across the business and promptly communicated so as to support effective and timely decision-making

- Iterative and responsive to business change

| Identify | Assess and control | Report | Manage and challenge |

|

|

|

|

COMPETITIVE LANDSCAPE

While each segment in the two-wheeler market is driven by a clear leader, competition continues to intensify in India's two-wheeler industry with many new global players entering into competition. Moreover, domestic and global players alike have expanded their product portfolio across entry, deluxe and premium segments.

We, at Hero MotoCorp, have maintained our leadership in the past five years of our solo journey, amid increasing competition. We have scaled up our in-house R&D capability, processes and systems. We will continue to work to set new benchmarks in product introductions and innovations, global expansion and staying closer to the customer.

EVOLVING CUSTOMER PREFERENCES, DRIVING STRUCTURAL INDUSTRY SHIFTS

Evolving customer preferences, higher disposable income, increasing urbanisation and infrastructure turnaround may lead to structural and segmental shifts in the two-wheeler industry. Such an example is the case of scooters gaining prominence and the growth of premium motorcycles. We aim to make our processes, capabilities and plans more agile and adapt to the changing scenario with speed through a closer collaboration between marketing, product planning and research and development.

MACRO TRENDS

Unforeseen macro trends, such as improvement in infrastructure, rural income and global volatilities may affect the industry. We have worked towards diversifying our products and expanding into new markets to neutralise the impact of macro trends across markets.

REGULATORY CHANGES DRIVING TECHNOLOGY AND COST IMPLICATIONS

Focus on vehicular emissions has multiplied in recent times. Consequent fast paced upcoming regulatory changes will enhance technology standards and hence cost implications. We are consistently upgrading the technology framework in line with global benchmarks and rationalising costs across processes.

CYBER SECURITY THREATS

The Company's information systems, and those of its third-party service providers and vendors, are vulnerable to the increasing threat of continually evolving cyber security risks. A cyber security breach may adversely affect the Company's reputation, revenue and earnings.

We continue to strengthen our Information Technology controls to prevent emerging cyber security threats.

DECLINE IN COMPANY'S MARKET SHARE OR FAILURE TO ACHIEVE GROWTH

A decline in our market share in domestic markets or failure to achieve growth in export markets, whether due to capacity constraints, competitive pressures or other factors, could have an adverse impact on our growth plans.

We aim to maintain competitive economies of scale and maintain or grow market share in domestic/ export markets.

MARKETING STRATEGY OF APPEALING TO AND GROWING SALES TO MULTI-GENERATIONAL AND MULTI-CULTURAL CUSTOMERS

To sustain and grow the business over the long-term, the Company must continue to be successful in selling its products and promoting the experience of riding motorcycles and scooters to both masses and premium segment customers.

The Company's endeavour is to cater to premium segment motorcycles without adversely impacting the strength of the brand with the masses. To cater to the competition in scooters market, the company has launched two new scooters this year.