PRODUCT SALES

(NUMBER OF UNITS)

0.01% ![]() Y-O-Y GROWTH

Y-O-Y GROWTH

4.2% 5-YEAR CAGR

TOTAL NET INCOME

(` IN CRORES)

3.2% ![]() Y-O-Y GROWTH

Y-O-Y GROWTH

8.0% 5-YEAR CAGR

PROFIT AFTER TAX (PAT)

(` IN CRORES)

31.3% ![]() Y-O-Y GROWTH

Y-O-Y GROWTH

10.2% 5-YEAR CAGR

EARNINGS

PER SHARE

(`)

31.3% ![]() Y-O-Y GROWTH

Y-O-Y GROWTH

10.2% 5-YEAR CAGR

GROSS

BLOCK

(`)

RETURN ON AVERAGE CAPITAL EMPLOYED

(%)

ECONOMIC VALUE ADDED (EVA)

(` IN CRORES)

DIVIDEND PER SHARE

(`)

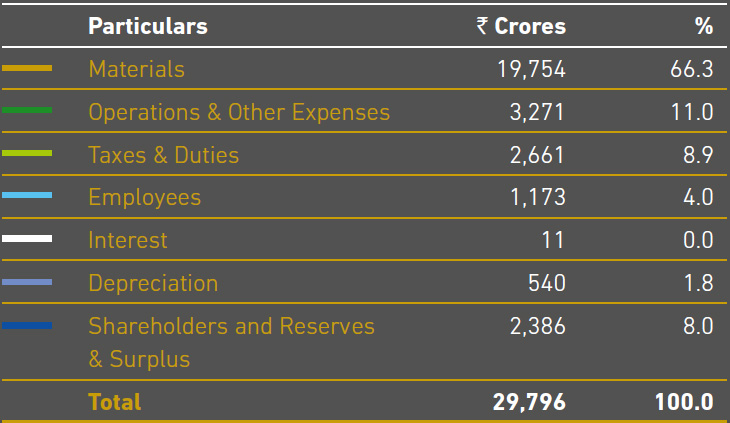

DISTRIBUTION OF REVENUE,

FY 2014-15

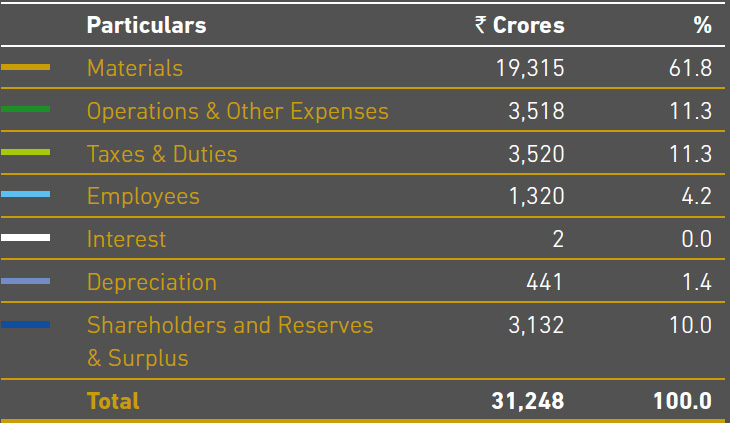

DISTRIBUTION OF REVENUE,

FY 2015-16

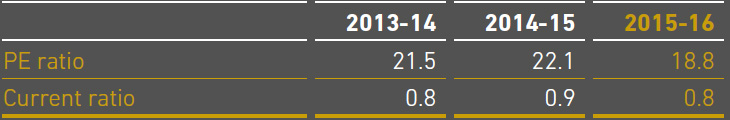

KEY FINANCIAL RATIOS

EQUITY SHARE INFORMATION

- Market Capitalisation (31st March, 2016): ` 58,823 Crores

- Proposed Dividend: ` 32 per share (Face value ` 2)

- Promoters Holding: 34.64%

- National Stock Exchange (NSE): HEROMOTOCO

- Bombay Stock Exchange (BSE): 500182

- Bloomberg Code: HMCL:IB (BSE) | HMCL: IS (NSE)