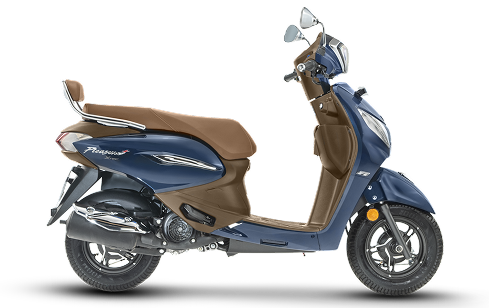

210 cc engine

#1

*Disclaimer: #1 in unit volumes sold by a single entity in a calendar year

VISION

Be The Future Of Mobility

MISSION

Create

Value for our customers by manufacturing affordable new age mobility solutions. Thus empowering them to move ahead in their lives riding the wave of development and innovation.

Collaborate

With co-workers and partners by drawing energy and inspiration to excel at everything, directed towards building a better world.

Inspire

A whole new generation of social and environment heroes by developing a worry free ecosystem conducive to sustainable mobility. Thus, paving the way to a greener, safer and equitable future.

VALUES

Passion

Be bold. Love what you do. Deliver your best.

Integrity

Be ethical and do the right thing, even when no one’s watching.

Respect

Be confident, but humble. Appreciate and acknowledge everyone. Celebrate diversity.

Courage

Take risks and question the status quo. Dare to be different.

Responsible

Be caring and accountable to your team, your organization, society and environment.

SUSTAINABILITY

Building A Shared Future

Make Way For The New Era Of Mobility

VIDA powered by Hero ushers in the Electric Age with new green mobility technology at the core and sustainability at its heart.

India’s First Fully

Integrated Electric Scooter

Worry Free

EV Ecosystem

Omni Channel

Customer Experience

300

1000

2

Manufacturing Facilities

Manufacturing Facilities

R&D Centres

R&D Centres

Hero We Care

OUR STORY

1984

19th January

1985

1987

1991

1994

1997

1999

2000

2001

2003

2005

2007

2008

2009

2011

2012

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

The Beginning: Hero Honda Motors Ltd. is born

The CD100 Revolution Begins - Changing the face of mobility

First Major Milestone: 1 Lakh (0.1 million) two-wheelers sold

- Splendor Launched

- Crossing 1 Million: 1 millionth two-wheeler rolls out

Expanding Horizons: Gurgaon plant inaugurated

First Premium Ride: Hero CBZ makes its debut

World Record: Splendor becomes the world’s largest-selling two-wheeler

- Birth of Iconic Passion

- Global Leadership: Hero - Honda becomes World’s number 1 two-wheeler company

Legend on the Road: Launch of Karizma

- Empowering Women: India’s first women’s scooter – Pleasure

- Glamour Arrives: Launch of Glamour

- Padma Bhushan awarded to Dr. Brijmohan Lall Munjal

Production Milestone:20 million two-wheelers produced

Growing Capacity: Haridwar plant inaugurated

A New Identity: Birth of Hero Motocorp

- Tiger Woods Joins the Ride: Global brand ambassador for Hero

- Strategic Infrastructure: Neemrana Plant and Global Part Centre Inaugurated

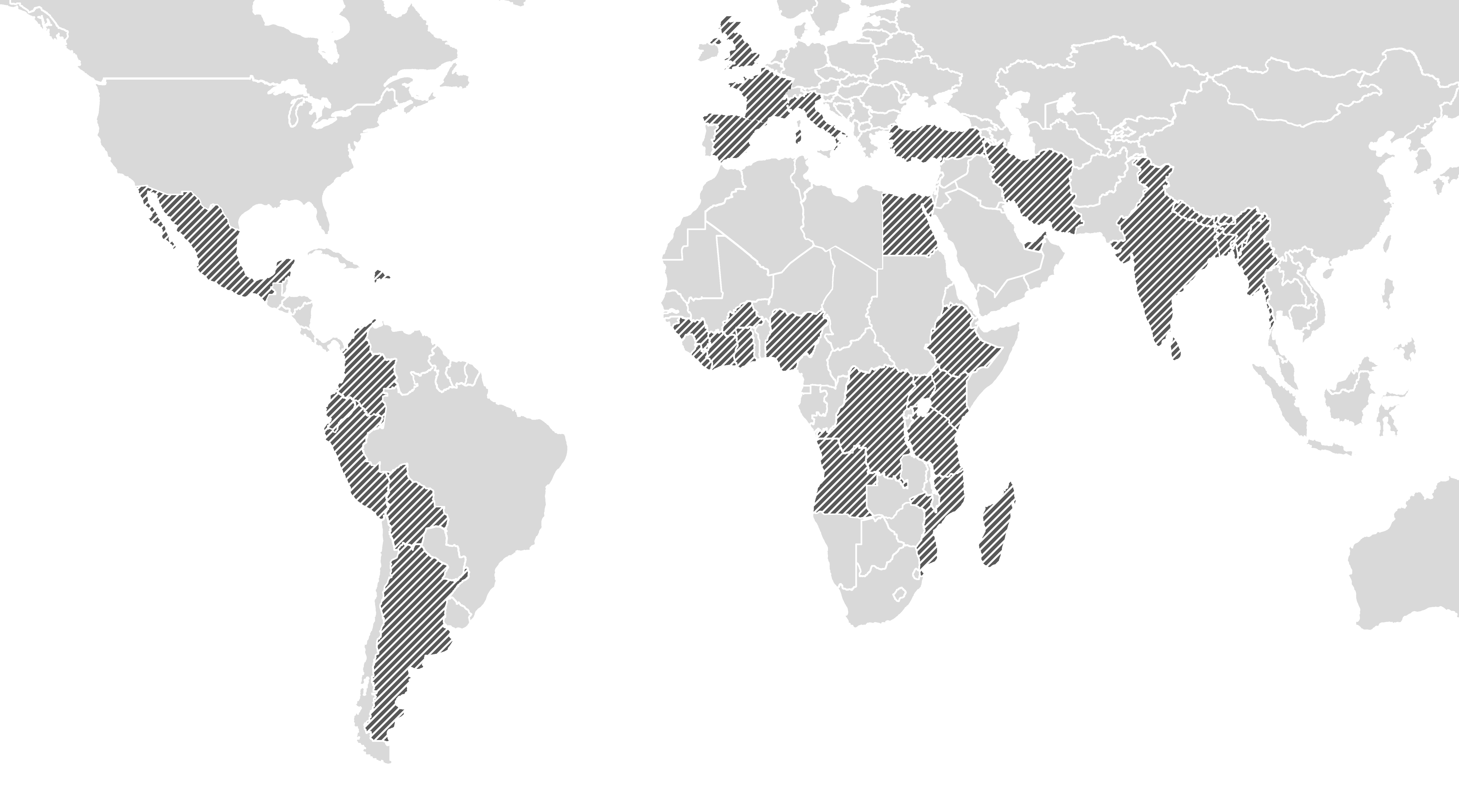

- Going International: Colombia plant inaugurated

- 50 Million Milestone: 50 Millionth two-wheeler rolls out

- Strengthening Innovation & Excellence: Centre for Innovation & Technology inaugurated

- Partnering for Success: Strategic the partnership with Ather

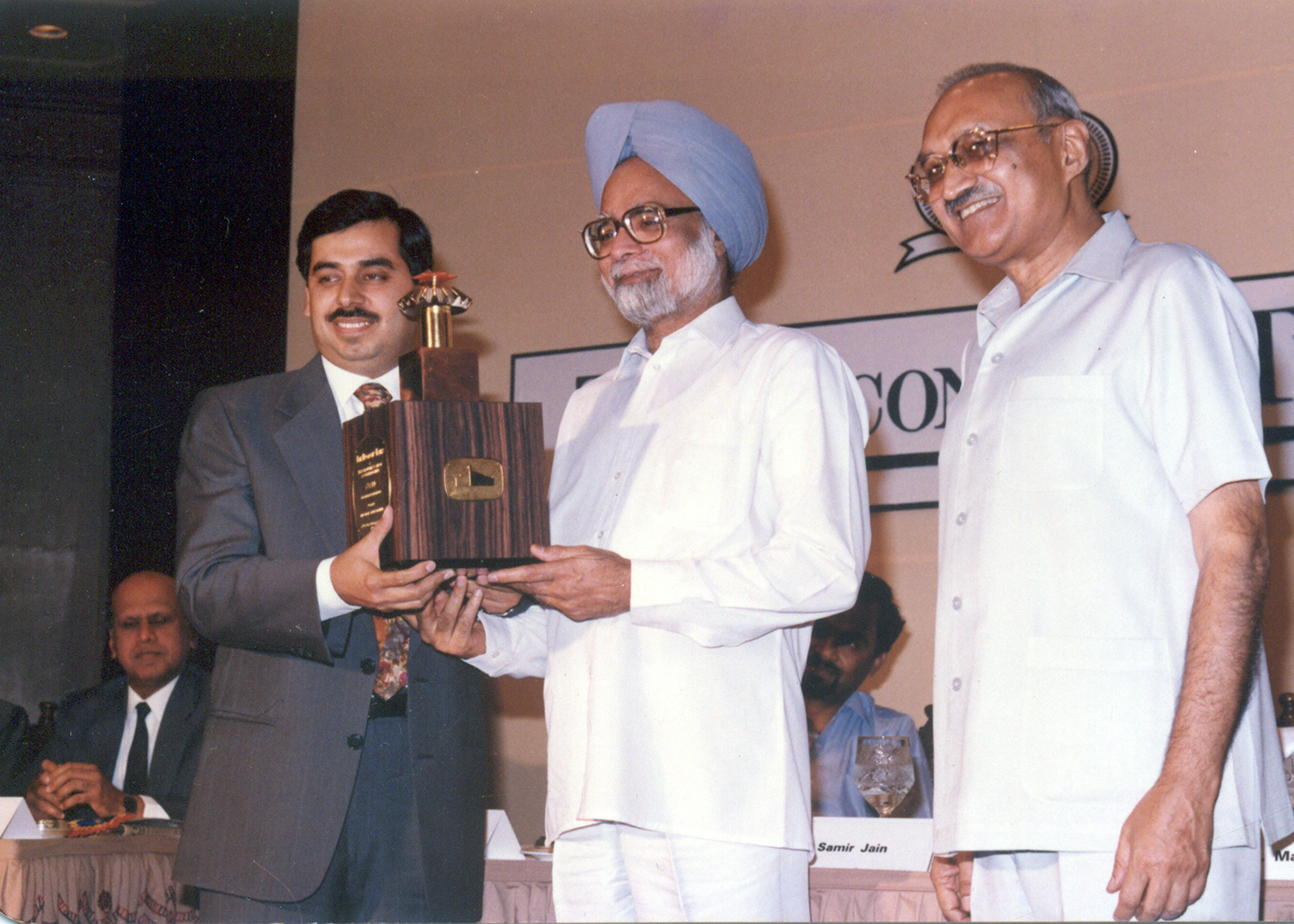

- Time India Awards – Manufacturing Innovator of the Year Award

- Expanding Presence- Halol Plant Inaugurated

- 60 Million Milestone: Continuing the legacy of growth

- 75 Million Strong: 75 millionth two-wheeler rolls out.

- Manufacturing Goes Global: Gujarat & Bangladesh Plants Start Operations

- Adventure Begins: Launch of first adventure motorcycle – Xpulse 200

- The Era of EVs: Vida brand launched globally ; launched first EV Scooter Vida V1 Pro

- Clinching the Podium - First Indian Team Podium at Dakar

- Expanding Horizons: Entry into the Philippines

- Premium Experience: Hero PREMIA – Premium Retail experience commences

- Introducing the X440: Hero-Harley Davidson’s First Motorcycle

- Surge S32: World’s first class changing vehicle

- Creating Value for Shareholders; Hero Motocorp crosses 1 lakh Crore market cap

- Launched Centennial Limited Edition Motorcycles - Commemorating the 100 Birth Anniversary of Dr. Brijmohan Lall Munjal

- Future Ready: Vida VX2 India’s First Evooter

- 125 Million Strong: 125,000,000th two-wheeler rolls out

1984

1985

1987

1991

1994

1997

1999

2000

2001

2003

2005

2007

2008

2009

2011

2012

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025