210 cc engine

How can we help you?

210 cc

4 Stroke 4 Valve Single Cylinder Liquid Cooled DOHC

280mm | 270mm

Rear and Front suspension travel

250 cc

4 Stroke, 4 Valve, Single Cylinder Liquid Cooled, DOHC

25 nm

@7250 RPM

210 cc

4 Stroke 4 Valve Single Cylinder Liquid Cooled DOHC

20.7 nm

@7250 RPM

97.2 cc

Air cooled, 4-stroke, Single cylinder, OHC

8.05 nm

@6000 RPM

124.7 cc

Air Cooled, 4-Stroke, OHC, Single Cylinder

10.6 nm

@6000 RPM

124.7 cc

Air Cooled 4 stroke

10.6 nm

@6000 RPM

163.2 cc

Air oil cooled, 4-stroke, Single cylinder, OHC

14.6 nm

@6500 RPM

199.6 cc

Oil Cooled, 4 stroke 4 Valve single cylinder OHC

17.35 nm

@6500 RPM

210 cc

Liquid cooled, 4-stroke, Single cylinder, OHC

20.4 nm

@4000 RPM

440 cc

Air cooled, 4-stroke, Single cylinder, OHC

38 nm

@4000 RPM

210 cc engine

250 cc engine

210 cc engine

97.2 cc engine

97.2 cc engine

97.2 cc engine

97.2 cc engine

97.2 cc engine

97.2 cc engine

125 cc engine

125 cc engine

125 cc engine

124.7 cc engine

124.7 cc engine

163.2 cc engine

163.2 cc engine

199.6 cc engine

210 cc engine

440 cc engine

440 cc engine

440 cc engine

210 cc

4 Stroke 4 Valve Single Cylinder Liquid Cooled DOHC

280mm | 270mm

Rear and Front suspension travel

250 cc

4 Stroke, 4 Valve, Single Cylinder Liquid Cooled, DOHC

25 nm

@7250 RPM

210 cc

4 Stroke 4 Valve Single Cylinder Liquid Cooled DOHC

20.7 nm

@7250 RPM

97.2 cc

Air cooled, 4 stroke

8.05 nm

@6000 RPM

97.2 cc

Air cooled, 4-stroke, Single cylinder, OHC

8.05 nm

@6000 RPM

97.2 cc

Air cooled, 4-stroke, Single cylinder, OHC

8.05 nm

@6000 RPM

97.2 cc

Air cooled, 4-stroke, Single cylinder, OHC

8.05 nm

@6000 RPM

97.2 cc

Air cooled, 4-stroke, Single cylinder, OHC

8.05 nm

@6000 RPM

97.2 cc

Air cooled, 4-stroke, Single cylinder, OHC

8.05 nm

@6000 RPM

125 cc

Air cooled, 4-Stroke

10.5 nm

@6500 RPM

125 cc

5.7 sec, Acceleartion 0-60kmph

10.5 nm

@6500 RPM

125 cc

Air cooled, 4-stroke, Single cylinder, OHC

10.6 nm

@6000 RPM

124.7 cc

Air Cooled, 4-Stroke, OHC, Single Cylinder

10.6 nm

@6000 RPM

124.7 cc

Air Cooled 4 stroke

10.6 nm

@6000 RPM

163.2 cc

Air oil cooled, 4-stroke, Single cylinder, OHC

14.6 nm

@6500 RPM

163.2 cc

Air Cooled 4 stroke

14 nm

@6500 RPM

199.6 cc

Oil Cooled, 4 stroke 4 Valve single cylinder OHC

17.35 nm

@6500 RPM

210 cc

Liquid cooled, 4-stroke, Single cylinder, OHC

20.4 nm

@4000 RPM

440 cc

Oil cooled, 4-stroke, Single cylinder, OHC

36 nm

@4000 RPM

440 cc

Air cooled, 4-stroke, Single cylinder, OHC

38 nm

@4000 RPM

440 cc

Air cooled, 4-stroke, Single cylinder, OHC

38 nm

@4000 RPM

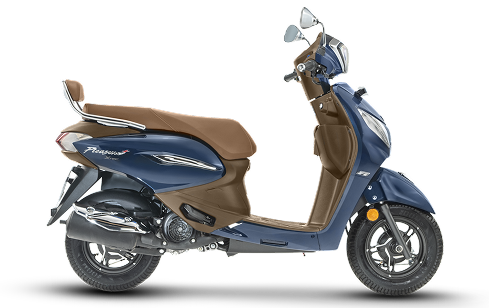

110 cc engine

125 cc engine

156 cc engine

124.6 cc engine

124.6 cc engine

110.9 cc engine

110.9 cc engine

110 cc

Air Cooled, 4 stroke engine

8.87 nm

@5750 RPM

125 cc

Air cooled, 4 stroke, SI engine

10.4 nm

@5500 RPM

156 cc

Liquid cooled, 4 Valve single cylinder SOHC

14 nm

@6250 RPM

124.6 cc

Air Cooled, 4 stroke, SI

10.4 nm

@6000 RPM

124.6 cc

Air Cooled, 4-Stroke, SI Engine

10.36 nm

@5500 RPM

110.9 cc

Air cooled, 4-stroke, SI engine

8.70 nm

@5750 RPM

110.9 cc

Air cooled, 4-stroke Single Cylinder OHC

8.70 nm

@5500 RPM

NO MOTORCYCLE FOUND

Please change your engine and price range

NO SCOOTERS FOUND

Please change your engine and price range

Rides & Community

Stay ahead of the curve with us!

A new revolution

is here

Rides & Community

Stay ahead of the curve with us!

FINANCIAL REPORTS AND PRESENTATIONS

DOWNLOADCREATE. COLLABORATE. INSPIRE

EXPLORE CAREER OPTIONS

Thank you for reaching out!

Your enquiry has been received and we will connect with you soon

Failed

Please try again later

Angola

Angola

Argentina

Argentina

Bangladesh

Bangladesh

Bolivia

Bolivia

Colombia

Colombia

Costa Rica

Costa Rica

Dominican Republic

Dominican Republic

DRC

DRC

Ecuador

Ecuador

El Salvador

El Salvador

Ethiopia

Ethiopia

France

France

GCC

GCC

Great Britain

Great Britain

Guatemala

Guatemala

Guinea

Guinea

Guyana

Guyana

Haiti

Haiti

Honduras

Honduras

Italy

Italy

Kenya

Kenya

Madagascar

Madagascar

Mexico

Mexico

Myanmar

Myanmar

Nepal

Nepal

Nicaragua

Nicaragua

Nigeria

Nigeria

Panama

Panama

Peru

Peru

Philippines

Philippines

South Africa

South Africa

Spain

Spain

Sri Lanka

Sri Lanka

Tanzania

Tanzania

Trinidad

Trinidad

Turkey

Turkey

Uganda

Uganda

Zambia

Zambia

%201.png)