210 cc engine

SEE TESTIMONIALS

Our Customers Love Us.

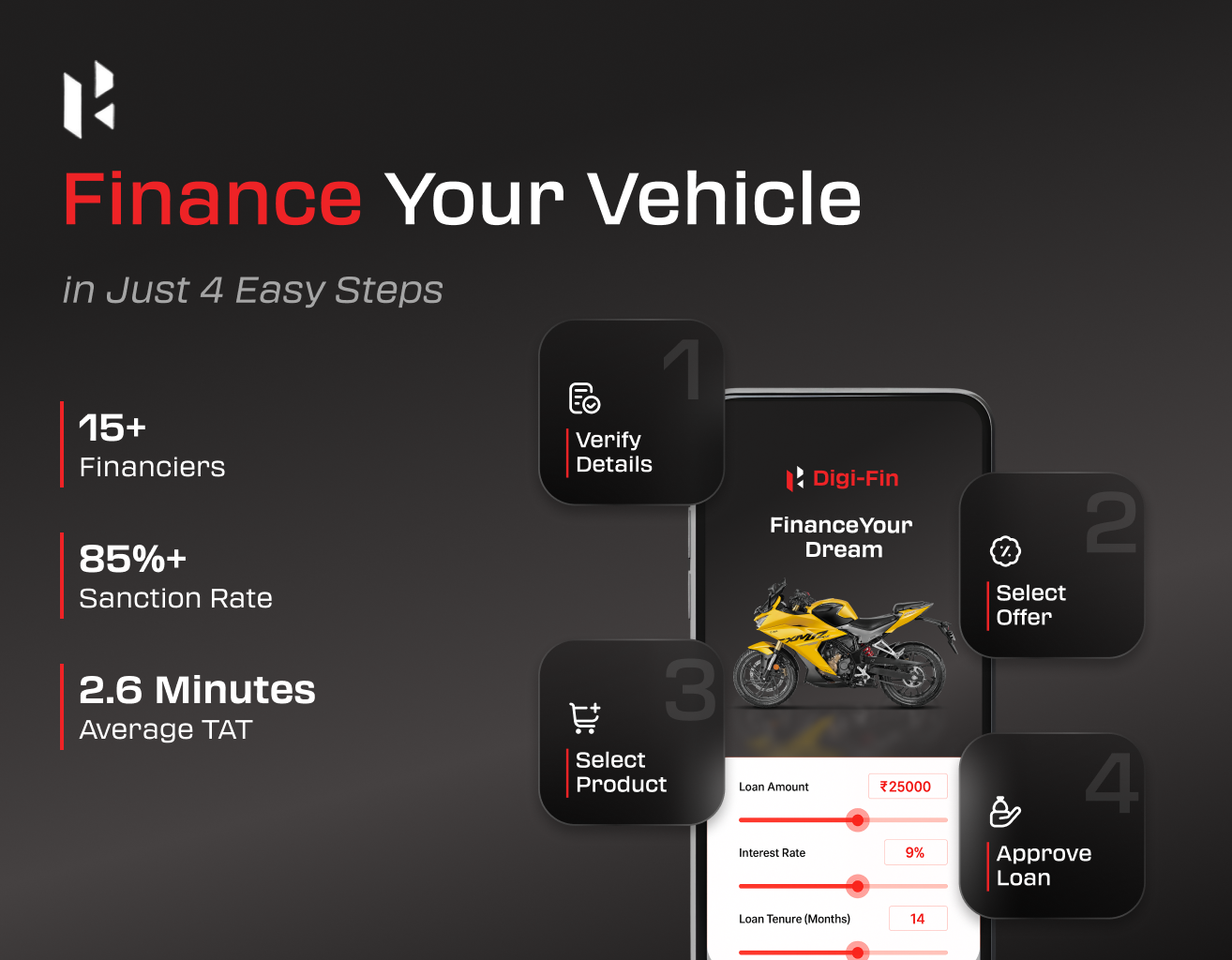

1. What is Hero DigiFin?

Hero DigiFin is Hero MotoCorp’s Digital Retail Finance Marketplace platform that helps you view, compare and choose the best suited two wheeler loan offer from 15+ trusted financing partners in one place.

2. Why DigiFin? Why should I apply online?

DigiFin has partnered with the top 10 trusted non-captive two wheeler loan financiers, including India’s top banks.

In under 5 minutes, you can compare pre-approved and custom offers across financiers— with a comparative view of rate of interest, down payment and EMI—all in one place.

This means you get full clarity and transparency upfront, without the hassle of visiting multiple financiers or uploading any documents.

By the time you step into the dealership, you already know the lowest ROI and most affordable plan available to you.

3. How do I apply for a loan through Hero DigiFin?

The loan application process can be done in 4 simple steps—all within 5 minutes.

You can apply by visiting the Hero MotoCorp website or any authorized dealership. Just select your preferred Hero two-wheeler and provide a few basic details.

Based on this, you'll instantly receive pre-approved and customized loan offers from multiple financiers.

4. Can I choose how much EMI I want to pay?

Yes! With Hero DigiFin, you can adjust your loan amount and tenure to get EMIs that fit your budget comfortably — giving you full control over your repayment.

5. What documents do I need to get started?

You don’t need to submit any document to complete the online loan sanction process. At this stage, only basic details are required to be submitted.

However, when you proceed with the financier at the time of delivery, you’ll need to provide standard KYC documents or any other relevant documents as required by the chosen financier.

6. How much time will it take me to get loan offers on Hero DigiFin?

It takes only 5 minutes to complete the journey and view tailored loan offers from 15+ trusted financiers—quick, seamless, and entirely online.

7. Can I complete the entire Financing Journey online or I need to do some process offline also?

Yes! You can complete the process online up to the stage of receiving a provisional sanction letter.

This letter gives you instant clarity on your eligibility, potential loan amount, and repayment terms from multiple financiers— before you even visit the dealership.

The final step— loan disbursal— requires standard checks like KYC and document submission. These are completed with the financier at the dealership during vehicle delivery.

8. What is the standard KYC process?

The KYC process is completed offline with your chosen financier.

Once your KYC is successfully verified, the loan disbursement is carried out by the financier at the dealership before vehicle delivery.

In case of any mismatch in the KYC details, your loan offer or approval terms may be revised accordingly.

9. Can I use the sanction letter generated online to take vehicle delivery from the dealership?

The sanction letter you get online is a provisional approval. It gives you early clarity on your loan eligibility and terms before completing any paperwork.

To take delivery, you’ll just need to finish the KYC process with your chosen financier.

Once verified, the financier issues the final sanction letter, which is used for loan disbursement and vehicle delivery.

10. When does my EMI repayment start or interest be charged?

Your EMI repayment begins only after your vehicle is delivered and the loan is disbursed by the financier. Until delivery, there are no EMIs or interest charges.

11. How long is the sanction letter issued by DigiFin Valid?

It is valid for 30 days.

12. Is Hero DigiFin a safe way to get a bike loan?

Hero DigiFin is a secure online retail finance marketplace platform developed and wholly owned by Hero MotoCorp—India’s leading two-wheeler manufacturer with over 125 million customers worldwide.

Built on Hero MotoCorp’s legacy of trust, DigiFin ensures that your information is fully protected (refer to privacy policy or T&C for more info) while connecting you with 15+ trusted financiers for instant, pre-approved and customised loan options.

13. I have some queries with Hero DigiFin. How can I get help?

No worries! If you have additional questions or run into any issues, you can reach us at grievance.finance@heromotocorp.com or call our toll-free number 1-800-266-0018. You can also walk into your nearest Hero dealership, where the team will be happy to assist you.

Angola

Angola

Argentina

Argentina

Bangladesh

Bangladesh

Bolivia

Bolivia

Colombia

Colombia

Costa Rica

Costa Rica

Dominican Republic

Dominican Republic

DRC

DRC

Ecuador

Ecuador

El Salvador

El Salvador

Ethiopia

Ethiopia

France

France

GCC

GCC

Great Britain

Great Britain

Guatemala

Guatemala

Guinea

Guinea

Guyana

Guyana

Haiti

Haiti

Honduras

Honduras

Italy

Italy

Kenya

Kenya

Madagascar

Madagascar

Mexico

Mexico

Myanmar

Myanmar

Nepal

Nepal

Nicaragua

Nicaragua

Nigeria

Nigeria

Panama

Panama

Peru

Peru

Philippines

Philippines

South Africa

South Africa

Spain

Spain

Sri Lanka

Sri Lanka

Tanzania

Tanzania

Trinidad

Trinidad

Turkey

Turkey

Uganda

Uganda

Zambia

Zambia