210 cc engine

Stock Watch

210 cc

4 Stroke 4 Valve Single Cylinder Liquid Cooled DOHC

280mm | 270mm

Rear and Front suspension travel

250 cc

4 Stroke, 4 Valve, Single Cylinder Liquid Cooled, DOHC

25 nm

@7250 RPM

210 cc

4 Stroke 4 Valve Single Cylinder Liquid Cooled DOHC

20.7 nm

@7250 RPM

97.2 cc

Air cooled, 4-stroke, Single cylinder, OHC

8.05 nm

@6000 RPM

124.7 cc

Air Cooled, 4-Stroke, OHC, Single Cylinder

10.6 nm

@6000 RPM

163.2 cc

Air oil cooled, 4-stroke, Single cylinder, OHC

14.6 nm

@6500 RPM

199.6 cc

Oil Cooled, 4 stroke 4 Valve single cylinder OHC

17.35 nm

@6500 RPM

440 cc

Air cooled, 4-stroke, Single cylinder, OHC

38 nm

@4000 RPM

440 cc

Air cooled, 4-stroke, Single cylinder, OHC

38 nm

@4000 RPM

210 cc engine

250 cc engine

210 cc engine

97.2 cc engine

97.2 cc engine

97.2 cc engine

97.2 cc engine

97.2 cc engine

97.2 cc engine

125 cc engine

125 cc engine

125 cc engine

124.7 cc engine

163.2 cc engine

163.2 cc engine

199.6 cc engine

210 cc engine

440 cc engine

440 cc engine

440 cc engine

210 cc

4 Stroke 4 Valve Single Cylinder Liquid Cooled DOHC

280mm | 270mm

Rear and Front suspension travel

250 cc

4 Stroke, 4 Valve, Single Cylinder Liquid Cooled, DOHC

25 nm

@7250 RPM

210 cc

4 Stroke 4 Valve Single Cylinder Liquid Cooled DOHC

20.7 nm

@7250 RPM

97.2 cc

Air cooled, 4 stroke

8.05 nm

@6000 RPM

97.2 cc

Air cooled, 4-stroke, Single cylinder, OHC

8.05 nm

@6000 RPM

97.2 cc

Air cooled, 4-stroke, Single cylinder, OHC

8.05 nm

@6000 RPM

97.2 cc

Air cooled, 4-stroke, Single cylinder, OHC

8.05 nm

@6000 RPM

97.2 cc

Air cooled, 4-stroke, Single cylinder, OHC

8.05 nm

@6000 RPM

97.2 cc

Air cooled, 4-stroke, Single cylinder, OHC

8.05 nm

@6000 RPM

125 cc

Air cooled, 4-Stroke

10.5 nm

@6500 RPM

125 cc

5.7 sec, Acceleartion 0-60kmph

10.5 nm

@6500 RPM

125 cc

Air cooled, 4-stroke, Single cylinder, OHC

10.6 nm

@6000 RPM

124.7 cc

Air Cooled, 4-Stroke, OHC, Single Cylinder

10.6 nm

@6000 RPM

163.2 cc

Air oil cooled, 4-stroke, Single cylinder, OHC

14.6 nm

@6500 RPM

163.2 cc

Air Cooled 4 stroke

14 nm

@6500 RPM

199.6 cc

Oil Cooled, 4 stroke 4 Valve single cylinder OHC

17.35 nm

@6500 RPM

210 cc

Liquid cooled, 4-stroke, Single cylinder, OHC

20.4 nm

@4000 RPM

440 cc

Oil cooled, 4-stroke, Single cylinder, OHC

36 nm

@4000 RPM

440 cc

Air cooled, 4-stroke, Single cylinder, OHC

38 nm

@4000 RPM

440 cc

Air cooled, 4-stroke, Single cylinder, OHC

38 nm

@4000 RPM

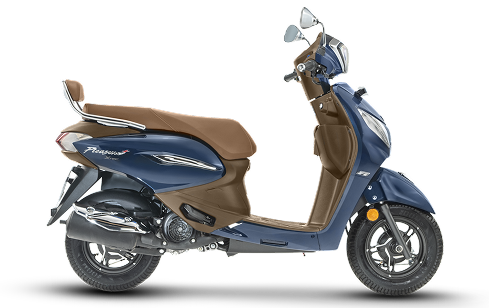

110 cc engine

125 cc engine

156 cc engine

124.6 cc engine

124.6 cc engine

110.9 cc engine

110.9 cc engine

110 cc

Air Cooled, 4 stroke engine

8.7 nm

@5750 RPM

125 cc

Air cooled, 4 stroke, SI engine

10.4 nm

@5500 RPM

156 cc

Liquid cooled, 4 Valve single cylinder SOHC

14 nm

@6250 RPM

124.6 cc

Air Cooled, 4 stroke, SI

10.4 nm

@6000 RPM

124.6 cc

Air Cooled, 4-Stroke, SI Engine

10.36 nm

@5500 RPM

110.9 cc

Air cooled, 4-stroke, SI engine

8.70 nm

@5750 RPM

110.9 cc

Air cooled, 4-stroke Single Cylinder OHC

8.70 nm

@5500 RPM

17 L

Total Volume

₹12,328 Cr

Revenue From Operations

₹1,810 Cr

EBITDA

₹1,349 Cr

Profit After TAX

Standalone Financial Results

INVESTOR TOOLKIT

KPRISM (Mobile Application): https://kprism.kfintech.com/

KFINTECH Corporate Website: https://www.kfintech.com

RTA Website: https://ris.kfintech.com

Investor Support Centre (DIY Link): https://ris.kfintech.com/clientservices/isc

+91-11-46044220

The Grand, Nelson Mandela Road, Vasant Kunj - Phase II, New Delhi-110 070, India

Hero MotoCorp Limited Commercial Space No. 2A-2B-1801, 18th Floor Two Horizon Centre, DLF City Ph-5 Gurgaon -122002 HR, India

.png)

.png)

.png)

.png)