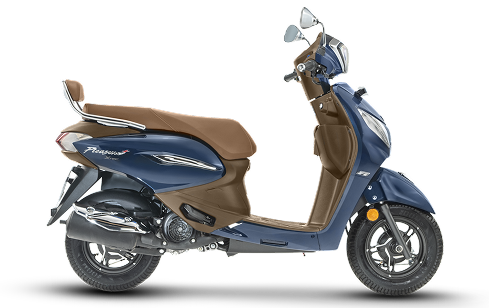

210 cc engine

Important information for members regarding Divided

Pursuant to the amendment in the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘SEBI Listing Regulations’), the provisions relating to "payable-at-par" warrants or cheques have been omitted from Regulation 12 and Schedule I of SEBI Listing Regulations.

Consequently, all dividend payments will now be remitted only through electronic mode.

Shareholders are advised to ensure that their bank account details are registered or updated with their Depository Participant in case shares are held in dematerialised form or with the Company’s Registrar and Share Transfer Agent, KFin Technologies Limited (“RTA”) for shares held in physical form.

For any support, please contact the RTA at einward.ris@kfintech.com and the Company at secretarialho@heromotocorp.com.

.png)