Management Discussion and Analysis Report

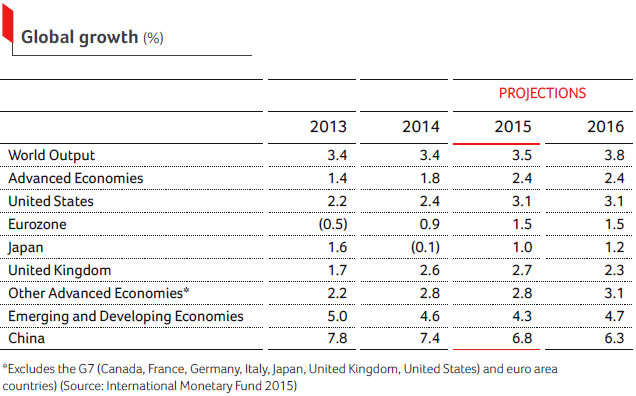

Global review

The global economy is progressing on a road to recovery, although volatilities and legacy risks are prominent across geographies. The big message for economies and businesses is to focus on a prudent cost structure, drive innovation and recalibrate strategies in line with shifting realities.

The FY 2014-15 witnessed contrasting patterns of growth, with consequent impact on currencies. The US economy performed well during the year and is well on track. The British economy also continued recovery with growing industrial output.

At the other end of the spectrum are Japan and Eurozone, which continue to grapple with uncertainties. The turbulence of the recession in 2008 is still casting its long shadows in these economies, and the recent uncertainties in Greece have the potential to create ripples not just in Europe but also around the world.

Emerging economies like Brazil and Russia, which set the pace for growth in the previous decade, now appear less dynamic, as commodity cycles are no longer in their favour. China too is being forced to rebalance itself with the slowdown in exports. Other emerging economies felt the effects of domestic policy tightening, political uncertainties and supply-side constraints. However, the drop in crude prices was an important and positive variable for oil-dependent nations.

Latin America

The economies of Latin America are grappling with sluggish and fragile growth patterns. FY 2014-15 presented many challenges for the region, primarily due to slower growth in China (a significant trade partner), low commodity prices and uncertainty surrounding the US monetary policy. These roadblocks are likely to persist throughout 2015 and gradual recovery is expected from 2016 onwards.

Of course, since Latin America is not a homogenous economic zone, some countries will absorb the shocks better than others. Macroeconomic management has improved in many economies in the region, although many nations in the continent continue to struggle under huge current account deficits.

Countries facing the Pacific Ocean (Chile, Colombia, Mexico and Peru) are expected to perform better than their counterparts (Argentina, Brazil and Venezuela) facing the Atlantic Ocean in 2015, primarily due to their stronger fiscal positions, as well as improved foreign currency debt ratios.

Africa

Africa’s achievements have been remarkable and the overall outlook for the continent is optimistic. This is an exciting time for Africa, home to perhaps the world’s youngest population, working hard to achieve their aspirations for a better life.

Many economies of Africa will soon be catching up with their pre-crisis (2008-09 global economic disaster) growth levels. Sub-Saharan Africa is clearly taking off – growing steadily for nearly two decades and showing a remarkable resilience in the face of the global financial crisis.

Overall, from a company perspective, outlook in many of the nations in which Hero is present in Central and South America remains positive. Selected nations in Africa that have a Hero presence are also expected to do quite well.

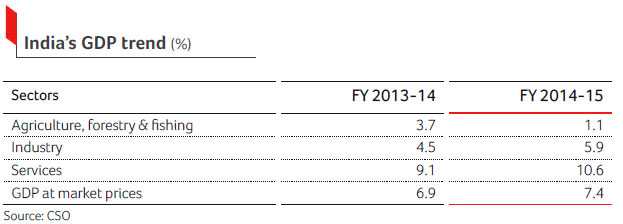

India review

India’s macro-economic prospects have strengthened and the country is best positioned to see consistent growth, going forward. The new government facilitated economic rebound with reforms and more are on the anvil. The government has unveiled a new statistical method to calculate the national income with a broader framework, hence the GDP touched 7.4% in FY 2014-15.

This progress has come on the back of gradually improving performance in the industrial landscape, stable growth in the services sector and a resilient agricultural sector. Inflation is now moderating and both fiscal and current account deficits are now narrowing down. The government’s policy initiatives are certainly in the right direction.

According to the Government of India’s latest Economic Survey, the share of stalled government projects as a proportion of GDP is declining. In the next one or two years, a uniform Goods and Services Tax (GST) across India and enhanced focus on federalism are expected to create even stronger multipliers of growth across the economy.

Outlook

India is a rapidly transforming society. The country’s demographic advantage and enhanced investments in infrastructure, manufacturing, education and socio economic wellbeing are expected to create new opportunities for growth. India’s sub-urban and rural people are creating room for further growth as their quality of life is improving at a rapid pace. The government’s reforms will further strengthen investor confidence in the country’s potential and unleash a free flow of entrepreneurial energy. At the same time, India’s consumer spending is rising consistently. It is expected to double in another decade or so. This will make India the world’s fifth largest consumer market, leading to major growth in all contributing sectors. Hero MotoCorp is invested in the India Growth Story and will continue to take relevant strategies to grow.

India's two-wheeler industry has seen a continuous upsurge in demand, for many reasons. Firstly, the country's aspirational 'youth bulge' and their high disposable income is a significant growth driver. Secondly, growing rural income across India has played a part in enhancing two-wheeler sales. Finally, poor public transport and an urgent need to avoid urban congestion has increased need for a quicker and more affordable mode of transport.

With faster economic development, enhanced employment opportunities and the participation of more women in the workforce, the industry is poised for sustainable growth. The country's manufacturers are also strengthening their export presence and volumes globally.

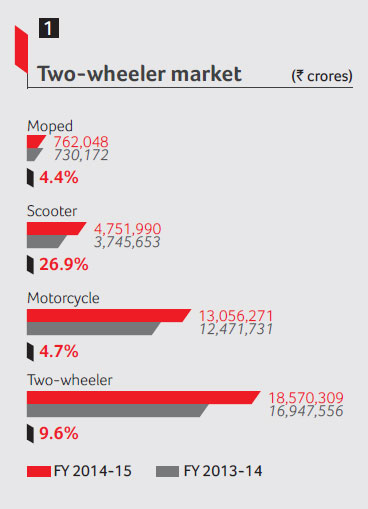

1 Indian two-wheeler industry overview

Two wheelers continue to dominate the Indian automotive space. During the year in review, two-wheeler production made up 79% of overall vehicles produced in India, compared to 75% five years ago.

The two-wheeler industry witnessed a moderate improvement in FY 2014-15, compared to the previous year. The industry grew at close to double digit from 16.9 million units in FY 2013-14 to 18.57 million units in FY 2014-15. However, motorcycle sales, which accounted for nearly 80% of the industry pie, grew by 4.7%, from 12.47 million units in FY 2013-14 to 13.06 million units in FY 2014-15.

For many years, the industry has been dependent on motorcycle demand to drive growth; during the year in review, it was the growth in scooter sales, which saved the industry from the blushes.

The scooter category showed significant growth. It witnessed a 26.9% sales escalation, from 3.75 million units in FY 2013-14 to 4.75 million units in FY 2014-15. This category saw resurgence due to launch of gearless scooters catering to the needs of both men and women. While men mostly prefer motorbikes, scooters are preferred by women because they are more convenient.

During the year in review, the sales of moped went up by 4.4%, from 0.73 million units in FY 2013-14 to 0.76 million units in FY 2014-15.

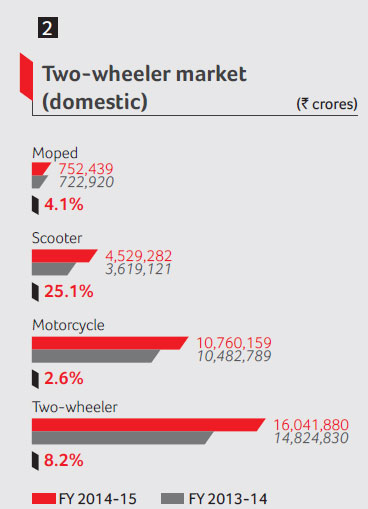

2 Two-wheeler industry (domestic)

The domestic two-wheeler industry sales

grew by 8.2% in FY 2014-15 to 16.04

million units, compared to 14.82 million

units in FY 2013-14. Motorcycle sales grew

by 2.6%, from 10.48 million units in

FY 2013-14 to 10.76 million units in

FY 2014-15. The scooter category saw a

25.1% sales growth, from 3.61 million units in FY 2013-14 to 4.52 million units in

FY 2014-15. Moped sales expanded by

4.1% from 0.77 million units in FY 2013-14

to 0.75 million units in FY 2014-15.

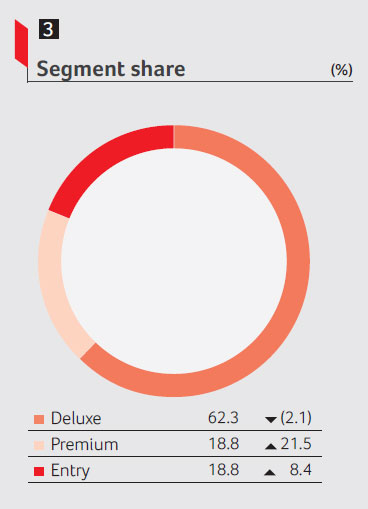

3 Two-wheeler industry - segmental review

The two-wheeler industry comprises three distinct segments - entry, deluxe and premium. In FY 2014-15, the deluxe category accounted for 62.4% of sales. The entry and premium segments accounted for 18.8% of sales each.

The entry segment, which accounted for 2.2 million units in FY 2014-15, grew by 8.4%. However, the premium segment grew by 21.5% with 2.19 million units in FY 2014-15, compared to 1.81 million units in FY 2013-14. The sales in the industry's deluxe segment experienced a marginal decline of 2.1% to 7.2 million units in FY 2014-15. Scooter segment volumes touched 2.9 million units in FY 2014-15 from 2.6 million units in FY 2013-14.

Two-wheeler industry (exports)

The export sales of the two-wheeler industry grew by 15.4% to 2.3 million units. Overall, the growth in all categories showed a positive trend in the industry performance.

Two-wheeler exports continue to present a strong opportunity for industry participants to expand presence in geographies, such as Africa and Latin America that have low twowheeler penetration, inadequate public transport infrastructure and growing population.

Outlook

While gauging two-wheeler industry growth, there is unfortunately, a tendency to look at the short term and under emphasise the long term. This is short-sighted; India remains a country where four out of five homes still don't own a two-wheeler. This is true for many developing nations around the world as well.

Besides, over the last decade, two-wheeler ownership in rural homes has grown significantly in a number of states, indicating the underlying growth potential.

Currently, the Company is present in 22 countries.

Enthusiasm and teamwork are driving the pursuit for operational excellence. Hero MotoCorp is fine-tuning focus into every aspect of execution and creating value consistently for all stakeholders. The Company's financial acumen, strong balance sheet and best-in-class operating architecture has enabled it to survive and thrive amidst economic volatility and across industry cycles.

Operational canvas

During FY 2014-15, Hero MotoCorp reinforced its leadership in the two-wheeler market. The Company sold 6.63 million units in FY 2014-15, compared to 6.24 million units in FY 2013-14. In the motorcycle segment, the Company clocked a sale of 5.79 million units in FY 2014-15, compared to 5.53 million units in FY 2013-14.

The Company's domestic market share in the motorcycle segment stood at 52.8% in FY 2014-15, with sales of 5.67 million units, vis-a-vis sales of 5.40 million units (market share of 51.8%).

The Company continues to maintain its position as the No. 1 two-wheeler company in the world for the 14th consecutive year.

Capacity expansion

Hero MotoCorp's four manufacturing facilities at Dharuhera, Gurgaon, Haridwar and Neemrana (which was commissioned during the year in review) have a total capacity of 7.65 million units. The Neemrana plant is being expanded further, and once complete, the overall capacity will be over eight million units.

The Gujarat plant will begin operations in FY 2016-17, and in a phased manner, capacity will be ramped up, just as in Neemrana.

By the end of March 2017, Hero plans to have a capacity of close to 10 million. These expansion plans do not include the proposed sixth Hero plant in Andhra Pradesh – land for which is being acquired.

Our global footprint has rapidly expanded since we commenced our solo journey in 2011.

Segmental review

Sales in the entry segment grew by 5.6% to 1.20 million units, resulting in a segment share of 54.9% on account of a strong showing by the Company's flagship models.

In the premium segment, the Company registered a 19.9% decline, with sales of 1.28 million units and 5.8% segment share.

In the deluxe segment, the Company's performance was encouraging, compared to the industry performance. The Company's sales grew by 5.9% to 4.78 million units, with a 60.9% segment share in FY 2014-15.

Overall, the top-six two-wheeler brands captured 53.5% market share of the entire domestic two-wheeler market. The Company's three flagship models (Splendor, Passion and HF Deluxe) featured among the top-six motorcycle brands sold in India.

The Company's two top-selling scooter brands (Pleasure and Maestro) continued to perform strongly. Sales grew by 13.6% and accounted for 21.4% of the twowheeler market.

International focus

Hero MotoCorp's exports continue to grow at a robust pace.

During FY 201 4-15, the Company exported 2,00,140 units, compared to 1,30,763 units in the previous year, resulting 53% growth in sales volumes. The Company received its single largest export order from Sri Lanka.

Hero MotoCorp forayed into Bangladesh in April 2014. The Company rolled out 11 popular motorcycles and scooters through 50 outlets. The Company joined hands with the Nitol Niloy Group of Bangladesh to set up its first manufacturing plant in this country.

In November 2014, the Company accomplished yet another significant milestone in the Company's global journey. The Company launched Hero in Colombia with six best-selling models. Hero is the first Company to offer a five-year and a four year warranty in Bangladesh and Colombia, respectively.

The Company has significantly shored up its global footprint since commencing the overseas journey in 2011. Currently, the Company has presence in 22 countries. It is present in Sri Lanka, Nepal and Bangladesh in Asia; Peru, Ecuador, Colombia, Guatemala, Honduras, El Salvador and Nicaragua in South and Central America; Kenya, Mozambique, Tanzania, Uganda, Ethiopia, Burkina Faso, Ivory Coast, Congo, Angola, Turkey and Egypt in Africa and the Middle East.

During FY 2015-16, the Company plans to enter large markets, such as Argentina, Mexico and Nigeria.

Outlook ahead

Overall, the Company expects the first half of FY 2015-16 to be challenging on account of slowing motorcycle sales in rural India. At the same time, the shift in the festival season from the second quarter to the third quarter (in FY 2014-15, the festive season was in Q2, leading to a spike in sales) could also show comparatively lower growth for the first half of FY 2015-16. However, higher government spending in infrastructure could propel a stronger recovery in the second half, in both urban and rural India.

To shore up performance, Hero is launching an upgraded version of its flagship product called the Splendor Pro as well as two new scooters by the second half. The Company expects these launches to catalyse sales.

Financial insight

During the year in review, the Company profitability was affected on the following counts.

There was an exceptional expense of ` 155 crores relating to a one-time provision made for the diminished value of the Company's investment in EBR. Also, during the year, the Company's marketing and publicity spend was 0.5% higher than the previous year. Hero MotoCorp is going global on a large scale, with plans of entering 50 markets by 2020. Manpower expenses increased by 0.6% on a Y-o-Y basis to shore up employee strength at both the upcoming R&D centre and the manufacturing facility in Rajasthan.

The reduction in margins were to an extent mitigated through the Company's margin improvement project, the LEAP Programme. On a standalone basis for the year in review, this programme contributed 118 basis points to margin.

Sales

During FY 2014-15, the Company registered total sales of 66,31,826 units, recording a 6% increase. In value terms, total sales (net of excise duty) increased by 9% to ` 27,351 crores in FY 2014-15 from ` 25,125 crores recorded in FY 2013-14.

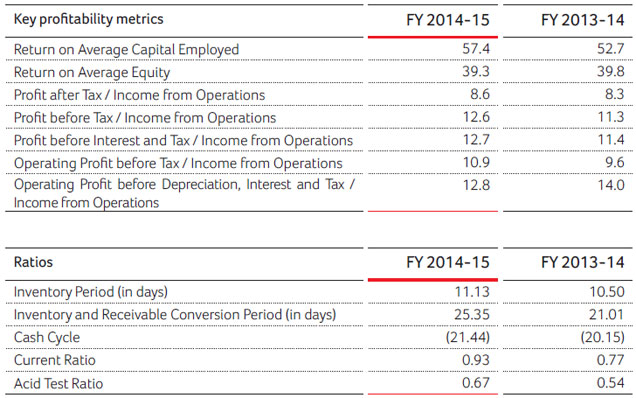

Profitability

The Company's earnings before interest, depreciation and taxes (EBITDA) margins decreased from 14.01% in FY 2013-14 to 12.84% in FY 2014-15. Moreover, the Company's operating margins increased from 9.62% to 10.88% during the same period. The Company's operating profit (PBT before other income) also increased from ` 2,433 crores in FY 2013-14 to ` 3,002 crores in FY 2014-15.

Other income (including other operating revenues)

The Company's other income increased by 22% from ` 597 crores in FY 2013-14 to ` 727 crores in FY 2014-15.

Cash flows

During the year, the free cash flow from operations stood at ` 2,250 crores (previous year ` 2,963 crores). These cash flows were deployed in capital assets, investments and also paid out as dividend during the year.

Raw material cost

During FY 2014-15, metal prices were volatile, particularly for steel, copper, aluminium and nickel. However, raw material costs as a proportion of sales declined from 72.56% to 72.22%.

Current asset turnover

The Company's current asset turnover, indicating sales as a proportion of average current assets (excluding investments) declined from 11.9 times to 10.7 times. This was primarily due to higher average inventory, trade receivables and loans and advances.

Debt structure

The Company has been debt-free for the past 14 years and incur no borrowing costs. Finance cost includes interest on account of advances from dealers and other transactional costs.

Dividend policy

Over the years, Hero MotoCorp has consistently followed a policy of paying high dividends, keeping in mind the cash-generating capacities, the expected capital needs of business and strategic considerations. For FY 2014- 15, the Board recommended a dividend of 3,000%, compared to previous year's 3,250%. The Company kept a payout ratio of 59.6%, compared to 72.0% in the previous year.

Working capital management

Hero MotoCorp has always sought to efficiently use the various components of its working capital cycle. It has also effectively controlled the receivables and inventories, enabling us to operate on a negative working capital.

3,000%

Dividend for FY 2014-15

6%

Increase in total sale unit

GoodLife was launched in 2000 and is now the largest CRM programme in the automotive sector with a customer base of more than 11 million.

14.4 MN

Transactions were processed under the Hero GoodLife Programme.

Hero GoodLife (customer engagement)

Hero GoodLife is an exclusive rewards and relationship programme for users and owners of Hero two-wheelers across the country. On successful enrolment, members are entitled to exciting rewards and benefits.

It was launched in 2000 and is now the largest CRM programme in the automotive sector with a customer base of close to 11 million.

Key highlights, FY 2014-15

Besides providing a consolidated base of loyal customers, Hero GoodLife has provided a new distribution platform for the Company. In FY 2014-15, more than 14.4 million transactions were processed under the Hero GoodLife Programme. Around 11% vehicle sales resulted from referrals by Hero GoodLife members.

During the year in review, Hero GoodLife customer usage was defined and tracked using Hero Connect. Dealer performance incentives were announced through enrolment and target achievements.

Service Har Jagah

A first-of-its-kind initiative, Hero MotoCorp has used Service Har Jagah to redefine service practices in the two wheeler industry.

A two-wheeler, specially modified to act as a workshop on wheels, reaches out to customers in the hinterland. Trained technicians from dealerships carry all essential tools and parts to undertake essential repair and maintenance service of customer bikes and scooters on a regular basis.

Through this programme, the Company has reached villages across different parts of India. Besides doorstep servicing, vehicles are also serviced at camps. So far, 44,000 camps have been held, and service requests for nearly 650,000 vehicles have been attended.

Hero Advantage

Hero Advantage is a unique customer centric programme that offers an extended warranty of up to five years. It covers the longest distance (70,000 km), provides the longest warranty (upto five years) and encompasses the largest number of components.

Rural initiatives

Common Services Centre

The Company has entered into a national tie-up with Common Services Centre (CSC) to provide ICT enabled front-end service delivery points at the village level.

The CSC initiative is being implemented under the National e-Governance Plan (NeGP) formulated by the Department of Electronics and Information Technology (DeitY), Government of India.

The Company has also entered into a Tripartite Agreement with CSC e-Governance Services India Ltd and Siemens to offer Assistant Motor Mechanic Course for the rural youth. The course is approved by Automotive Sector Skill Council and focuses on creating awareness about the essentials of two-wheeler design.

MoU with Punjab National Bank

The Company has entered into an MoU with Punjab National Bank (PNB), and the latter is now the preferred financier for rural financial needs. PNB has strong rural penetration, with over 6,000 rural branches.

Bharat Shresth Wave

The Bharat Shresth Wave 9.0 – an internal competition targeting rural customers – was a huge success. The top performing Bharat/Zonal Shresth Dealerships were given awards in Rome during the National Dealer Conference of 2015.

Rural training

During the year, training was conducted for rural sales executives to help them enhance reach and build relationships in rural markets. The Company also provided training on the refreshed Hero Saksham App, which has rolled out across almost the entire country.

Kushiyan Har Angan 2.0

Kushiyan Har Angan 2.0, a festival with rural customers, was a big hit in its refreshed version. Around 69 Opinion Leader Meets were organised, engaging over 10,000 opinion leaders. At such meetings, product launches, workshop visits, test rides and entertainment programmes were also organised.

Mission one million rallies

More than 250 rallies were organised and almost 1 lakh opinion leaders were feted by Hero two-wheeler teams.

Strengthening the logistic management system, by improving space usage, reducing cost and enhancing responsiveness.

The primary objective of forward and backward supply chain management at Hero is to build a prudent cost structure and grow sustainably, along with partners. Hero MotoCorp is helping supply chain partners to identify and eliminate initiatives that do not add substantial value to the operational ecosystem. Our partners are also adopting new technologies and platforms to accelerate processes and enhance quality.

Supplier operational excellence

The primary objective of supply chain management is to reduce the cost, and not the price of any commodity or a part. This approach has helped Hero's supply chain partners to identify non value added activities / process, as well as new technologies and systems.

The Company worked with a number of suppliers to enhance operational excellence. Energy audits were conducted in a number of supplier units to establish actual energy consumption.

Logistic management

The Company is strengthening its logistic management system, with the idea of improving space, reducing cost and enhancing responsiveness. Projects under implementation have:

- Reduced carbon footprint by reducing the number of truck trips;

- Reduced inbound logistic cost by enhancing truck volumetric utilisation;

- Reduced storage space, by increasing number of parts per trolley; and

- Improved quality, through better trolley designing to avoid damages.

The Company is also in the process of introducing and implementing a comprehensive Six Sigma programme with the help of an international expert. This should help identify new cost savings and productivity improvement areas.

E-sourcing and e-material flow

During the year, Hero MotoCorp introduced e-bidding in order to benefit from pricing, de-risking, sourcing and vendor consolidation. The Company also successfully launched e-material flow at the Haridwar plant, which helped reduce inventories and space requirements. E-material flow and 3PL is also being implemented at the Neemrana facility.

Hero Learning

In its constant endeavour to provide world-class experience to customers, Hero MotoCorp's 'Learning Function' focuses on people and process improvement through various skill initiatives. Hero Learning provides a platform to identify and reward dealer's talented staff members.

The Company has more than 50,

indigenously developed programmes

cutting across different functions of its

business. There are 14 state-of-the-art

technical learning centres imparting best-in-

class learning experience to all service

staff members. Over 45,000 participants

from channel partners benefited from

different learning programmes in

FY 2014-15.

The Company also conducted a national level competition for the sales and service staff of channel partners to enhance competitiveness.

The Company has more than 50, indigenously developed programmes cutting across different functions of its business. There are 14 state-of-the-art technical learning centres imparting best-in-class learning experience to all service staff members.

During the year, the Company initiated online booking of two-wheelers. Customers can now book their two-wheelers online, and take delivery from the dealership.

With a solid IT architecture, Hero seeks to make business processes more efficient, operations more cost-effective, decisions more meaningful, and collaboration among employees and partners better.

During the year in review, the Company set up one of the most automated warehouses in Asia – the Global Parts Centre at Neemrana. The overall ecosystem ensures that the warehouse operations are fully automated.

A content sharing system based on cloud now allows the Company to share content within the organisation and also with third parties.

A mobile based platform was launched for channel partners and their sales executives; the platform uses analytics for better data analysis in the field. The Company also deployed a mobility platform for capturing feedback of opinion leaders and sales leads. This platform is especially useful in rural areas.

The Company also launched a web presence in several countries to give global customers right information. Some key systems on sales planning and spare parts ordering were also implemented as part of a plan to upgrade the global business.

During the year, the Company initiated online booking of two-wheelers. Customers can now book their twowheelers online and take delivery from the dealership.

As a part of the Vision 2020, Hero aspires to expand its presence to 50 countries, with 20 manufacturing operations. This level of global visibility needs to be supported by robust business and people processes, a strong leadership pipeline and a high level of employee engagement.

The Company organised its first town hall meeting to promote employee engagement with top management. The theme was – 'Renew, Reinvigorate, Recharge'. For those who could not physically attend, arrangements were made for employees to participate through live web-cast, web-chats and audio conferencing.

To recognise performance, the Company initiated the Hero Achiever's Award in the areas of operational excellence, sustainable cost reduction (LEAP) and customer delight, among others. During the year, the Company also deployed a web-based application – iAppreciate that allows employees to exchange messages of appreciation among themselves.

Around 68 employees, rated as the top most performers during the previous year's Performance Appreciation & Competency Evaluation (PACE) Process, became members of the CEO's Champions Club. The initiative seeks to recognise best performers in the organisation and harness their talent.

During FY 2014-15, Hero also brought in a new-age online platform for PACE. The Employee Confirmation Process and the new Individual Development Planning (IDP) Process is already integrated with the new platform.

The Company also introduced a talent management process to identify the right talent at the right time in the organisation, align them in relevant positions and develop them as per the business objectives.

Skill augmentation and self-learning were a key focus area. The Company developed online IDPs for those seeking to enhance their knowledge.

A specially designed EDGE software now provides access to e-learning modules in partnership with globally recognised partner SkillSoft. Approximately 1,500 employees, representing operations, sales marketing, customer care, global business, and information systems now have access to a library of their preferred modules.

The Company's level of attrition stands at 6.1%, which is relatively lower than the industry average. Hero has initiated tie-ups with reputed universities to provide engineering and MBA programmes to employees. This enhanced employee retention.

The Company has overhauled the process of identifying risks, mitigating them and cascading the process across the organisation.

Our risk management framework attempts to minimise potential risks and create an ecosystem in which business objectives and obligations towards their customers, shareholders, employees and the society can be fulfilled.

In FY 2014-15, the Company constituted a Risk Management Committee, comprising selected Board and management committee members. The Company has overhauled the process of identification of risks, mitigation and cascading down the process across the organisation. Effective mitigation techniques are applied to manage potential risks and thus, protect the stakeholder's value.

Geopolitical and economic uncertainty

The Company is expanding its global footprint against the backdrop of growing geopolitical and economic uncertainty (political, tax structures, currency and financing). To mitigate risk, Hero is developing networks and capabilities to monitor the developments periodically and is modulating its strategy dynamically.

The Company is formulating an optimal

investment strategy for each of the global

markets, particularly where it needs to

invest in local manufacturing operations.

The Company is also keeping a close watch

on the natural currency hedge provided by

the interplay between imports

and exports.

Structural changes in the two-wheeler industry

The Indian two-wheeler market will continue to grow at a healthy rate in the years to come. The industry scenario will be driven by consumer preferences and innovative products offered by industry players. At Hero MotoCorp, the attempt is to modulate product-market and resource allocation in line with the changing scenario.

Regulatory changes driving technology implications

Regulatory debates and actions around automobiles have increased over the past few years. These would have a significant impact on the emission norms and regulations. Hero MotoCorp actively tracks drivers of these changes to strengthen technological preparedness.

Growing competition and customer preferences

Over the past few years, the competitive intensity in the Indian two-wheeler industry has increased. This manifests in a number of ways, including faster and greater product introductions, need for greater product innovations and increasing detachment of price from cost escalation. Hero is steadily enhancing its interventions to drive margins, product planning and delivery processes to mitigate this risk.

Positive industrial relations

Hero MotoCorp has traditionally always enjoyed strong industrial relations. To strengthen these relations, the Company is putting in place a systematic grievance redress system, and it regularly engages with the workforce. It is also placing much greater emphasis on training and soft skills development. Besides, at the Neemrana facility, the Company has built benchmark-setting manufacturing facilities where workers can actually experience 'manufacturing happiness'.