Momentum in Numbers

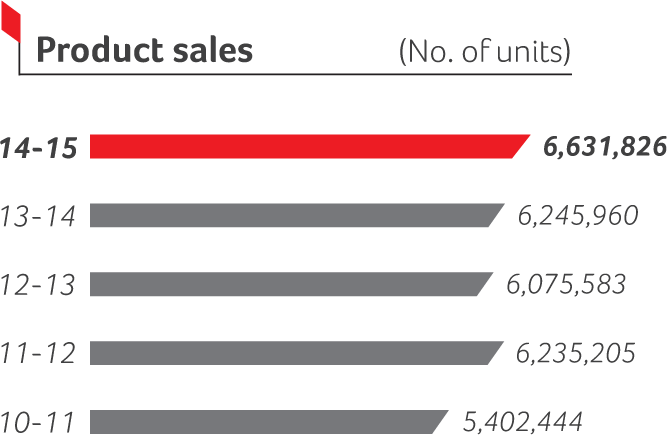

YoY growth 6.2%

Performance in FY 2014-15: Product sales grew on account of strong export sales and moderate domestic demand.

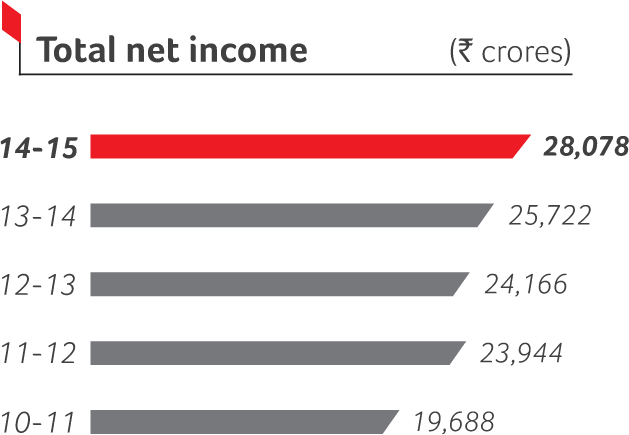

YoY growth 9.2%

Performance in FY 2014-15: Total net income rose on account of greater scale and higher sales.

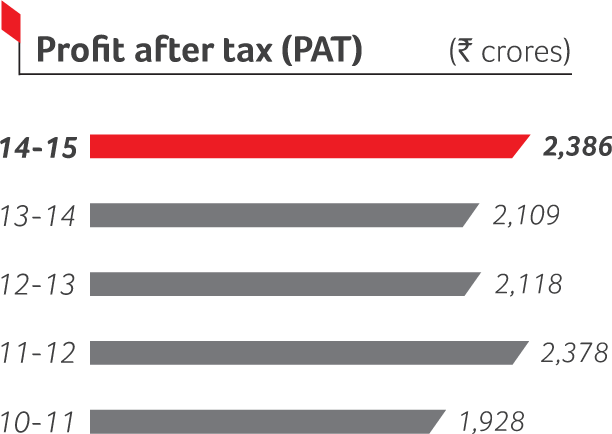

YoY growth 13.1%

Performance in FY 2014-15: PAT escalated owing to efficient operational architecture and higher realisations.

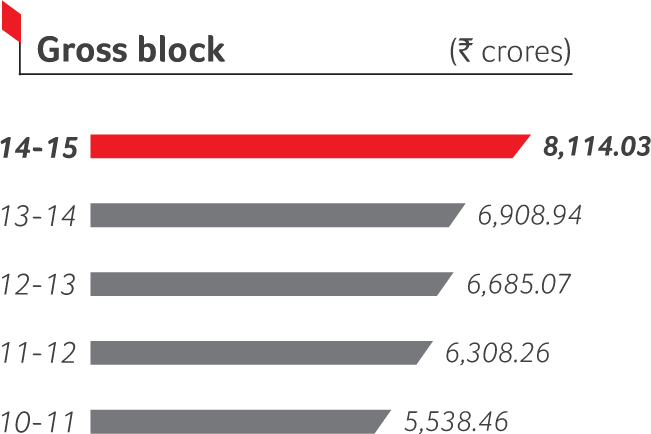

Performance in FY 2014-15: Gross block increased significantly owing to the completion of multiple expansion plans.

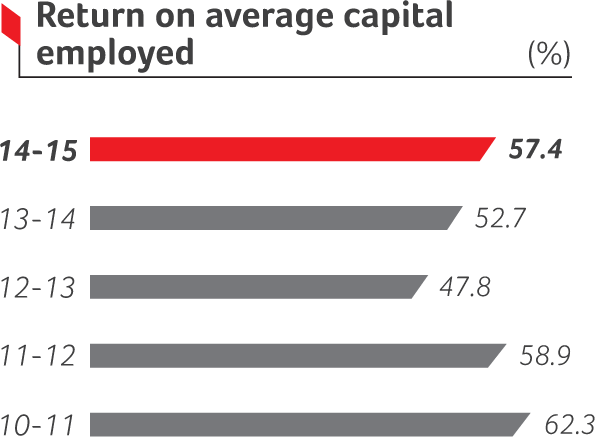

Performance in FY 2014-15: Return on average capital employed grew on account of effective utilisation of capital.

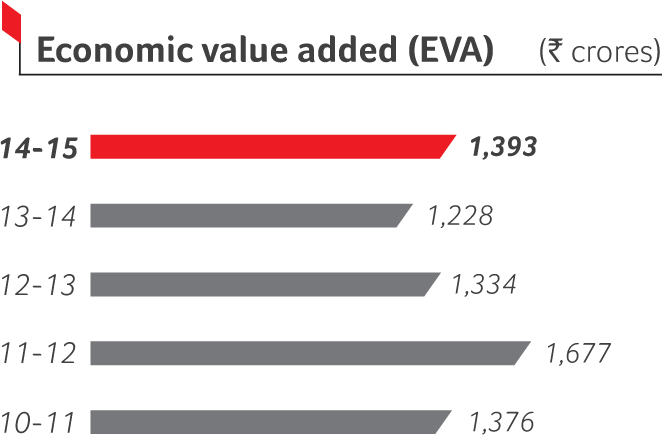

Performance in FY 2014-15: EVA grew on account of Hero’s concentrated focus on improving the net cash return on invested capital.

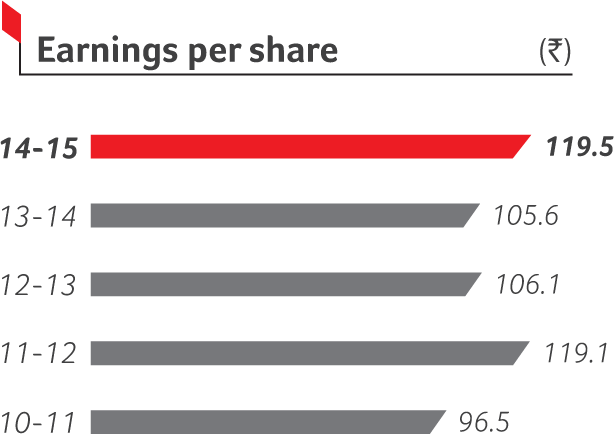

YoY growth 13.1%

Performance in FY 2014-15: Hero’s earnings per share grew on account of higher profitability.

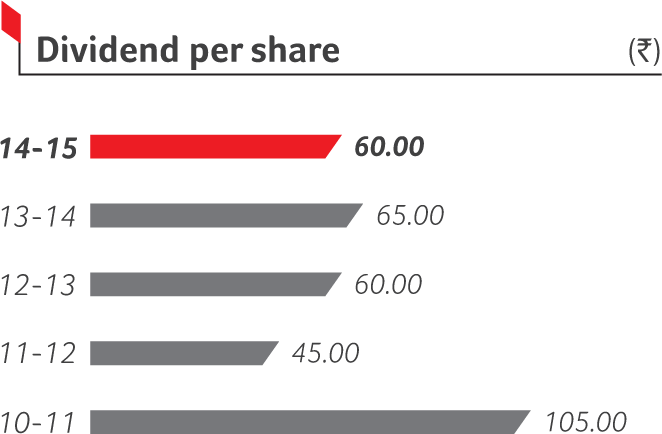

Performance in FY 2014-15: Dividend per share increased reflecting strong earnings and cash performance.

2014-15

22.10

PE Ratio

2013-14

21.54

2014-15

0.93

Current Ratio

2013-14

0.77

2014-15

11.13

Inventory Period Ratio

2013-14

10.50